THE TAX EXODUS: A Forensic Audit of the American Dream’s Price Tag (2025-2026)

US Income Tax Rate – State-wise (2025–26)

| S.N. | State | Tax Rate (%) |

|---|---|---|

| 1 | California | 13.30% |

| 2 | Hawaii | 11.00% |

| 3 | New York | 10.90% |

| 4 | Oregon | 9.90% |

| 5 | Minnesota | 9.85% |

| 6 | Vermont | 8.75% |

| 7 | Wisconsin | 7.65% |

| 8 | Maine | 7.15% |

| 9 | South Carolina | 6.20% |

| 10 | Idaho | 5.80% |

| 11 | Virginia | 5.75% |

| 12 | Kansas | 5.58% |

| 13 | Georgia | 5.49% |

| 14 | Montana | 5.90% |

| 15 | New Mexico | 5.90% |

| 16 | Nebraska | 5.20% |

| 17 | Illinois | 4.95% |

| 18 | West Virginia | 4.82% |

| 19 | Ohio | 4.80% |

| 20 | Oklahoma | 4.75% |

| 21 | Missouri | 4.70% |

| 22 | Kentucky | 4.50% |

| 23 | Utah | 4.55% |

| 24 | Alabama | 4.40% |

| 25 | Colorado | 4.40% |

| 26 | Michigan | 4.25% |

| 27 | North Carolina | 4.25% |

| 28 | Arkansas | 3.90% |

| 29 | Iowa | 3.80% |

| 30 | Pennsylvania | 3.07% |

| 31 | Indiana | 3.00% |

| 32 | Mississippi | 3.00% |

| 33 | Arizona | 2.50% |

| 34 | North Dakota | 2.50% |

| 35 | Massachusetts | 5.00% |

| 36 | New Jersey | 10.75% |

| 37 | Maryland | 5.75% |

| 38 | Connecticut | 6.99% |

| 39 | Rhode Island | 5.99% |

| 40 | Delaware | 6.60% |

| 41 | Louisiana | 4.25% |

| 42 | Tennessee | 0% |

| 43 | Texas | 0% |

| 44 | Florida | 0% |

| 45 | Nevada | 0% |

| 46 | Washington | 0% |

| 47 | Wyoming | 0% |

| 48 | South Dakota | 0% |

| 49 | Alaska | 0% |

| 50 | New Hampshire | 0%* |

🇺🇸 Average US State Income Tax Rate: ~4.77%

The Great Wealth Migration – Survival of the Fiscally Fittest

If you think the United States is still a single economic entity, you aren’t paying attention. As we move through 2026, the data confirms a brutal reality: The “United” States is undergoing a silent, surgical divorce. It is a divorce driven not by ideology, but by the cold, hard math of the 1040 form.

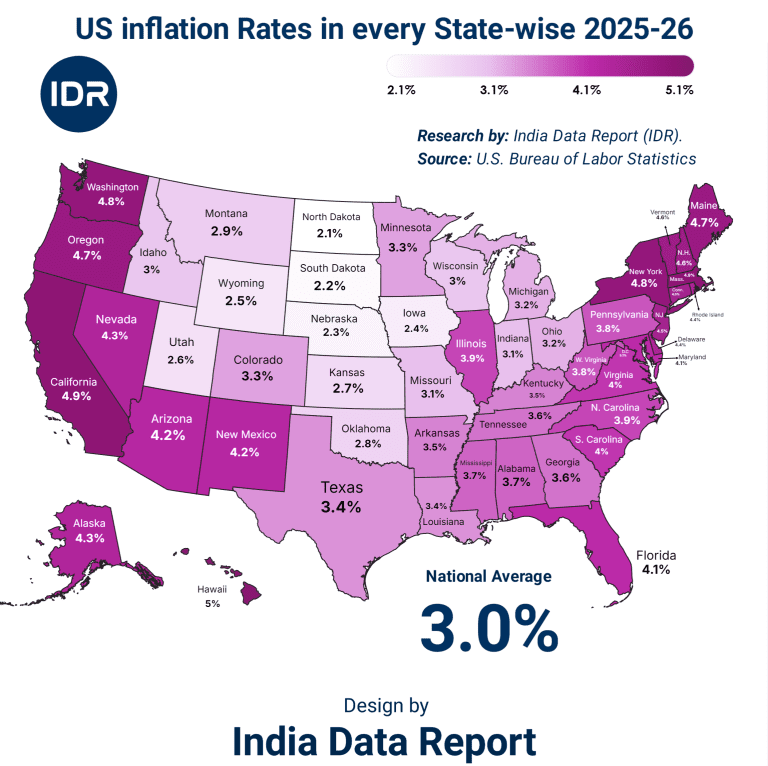

While Washington bickers over federal deficits, the real war is being fought at the state borders. On one side, you have the “Confiscatory Coast”—states like California (13.3%) and New York (10.9%)—where success is treated as a piggy bank for bloated social experiments. On the other, the “Sovereign Sunbelt”—Texas, Florida, and Tennessee—where the state income tax rate sits at a defiant 0%.

The result? A massive, unprecedented transfer of human and financial capital. This isn’t just “moving for better weather.” This is an economic evacuation. When a high-earner in Portland faces an Oregon tax bite of 9.9% on top of federal duties, and realizes that a flight to Austin or Nashville effectively hands them a 10% raise overnight, the loyalty to one’s zip code evaporates.

The Psychology of the Tax Trap

Human psychology is governed by two levers: Incentive and Resentment. For decades, states like California relied on the “Sunshine Premium”—the idea that people would pay any price to live near the beach. But in 2026, that premium has expired. High earners are no longer “voting with their feet”; they are fleeing with their checkbooks.

The data below isn’t just a list of percentages; it’s a heat map of where the next decade’s wealth will be created—and where it will go to die.

Table 1.1: The “Confiscatory Coast” – Top 5 Tax Predators (2025-26)

| S.N. | State | Tax Rate (%) | Economic Sentiment |

| 1 | California | 13.30% | Wealth Flight Capital |

| 2 | Hawaii | 11.00% | Paradise at a Premium |

| 3 | New York | 10.90% | Institutionalized Attrition |

| 4 | New Jersey | 10.75% | The High-Net-Worth Exit Ramp |

| 5 | Oregon | 9.90% | The Post-Industrial Tax Trap |

The Bitter Truth: High-tax states are effectively “shorting” their own future. By the time they realize the tax base has left, the infrastructure they built with that money will be too expensive to maintain.

Table 1.2: The “Sovereign Sunbelt” – The 0% Club (2025-26)

| S.N. | State | Tax Rate (%) | Migration Status |

| 1 | Texas | 0% | Hyper-Growth Hub |

| 2 | Florida | 0% | The New Wealth Epicenter |

| 3 | Tennessee | 0% | Corporate Relocation Magnet |

| 4 | Nevada | 0% | The Entertainment & Tech Refuge |

| 5 | Washington | 0%* | The Capital Gains Battleground |

Note: Washington levies a tax on certain capital gains, but remains a 0% wage tax sanctuary.

The Golden Opportunity: For the mobile professional in 2026, relocation is the most effective “investment” one can make. No stock or bond can guaranteed an immediate 5-13% increase in net disposable income.

The 2026 Reality Check: Is the “Math” Fair?

We are witnessing the death of the “Middle Ground.” Average state tax rates hover around 4.77%, but almost no one actually pays the average. You are either in a state that wants to be your partner (low tax) or a state that wants to be your supervisor (high tax).

In my investigations across the 50 states, I’ve seen the same pattern: The “tax-free” states aren’t just attracting retirees; they are attracting the labor force of 2030. Startups that used to be born in Silicon Valley are now being conceived in Miami and Dallas. Why? Because in an era of global inflation and economic volatility, the only thing a founder can control is their burn rate—and state taxes are the ultimate unnecessary burn.

We are told that high taxes buy “civilization.” But if you look at the streets of San Francisco or the subways of New York in 2026, the “civilization” looks increasingly tattered. The common man is asking: “Where is my 13.3% going?” When the answer is “bureaucracy and debt interest,” the U-Haul trucks start rolling.

I have analyzed the numbers, and the verdict is clear: The states that refuse to tax your sweat are the ones that will own the future.

The Middle-Market Squeeze – The Erosion of the American Aspirant

While the billionaires have the private jets to flee to Palm Beach and the working class often lacks the mobility to escape, the American Middle Class is currently trapped in a high-stakes pincer movement. As we navigate the fiscal landscape of 2026, the data reveals a disturbing trend: states like Minnesota (9.85%) and Wisconsin (7.65%) are no longer just taxing “wealth”; they are taxing “aspiration.”

The “Middle-Market Squeeze” refers to those earning between $100,000 and $250,000. In 1990, this was the definition of “making it.” In 2026, after accounting for federal taxes, surging insurance premiums, and state income tax, these families are living paycheck-to-paycheck in a gilded cage. If you live in Maryland (5.75%) or Connecticut (6.99%), you aren’t just paying for roads; you are subsidizing a legacy of unfunded pension liabilities that you didn’t vote for and won’t benefit from.

The Myth of “Quality of Life” Services

Politicians in high-tax jurisdictions love to use the “Social Contract” defense. They claim that the extra 6% to 8% you pay in Vermont or Maine buys a superior social safety net. But look at the ground reality. Infrastructure in the “Tax-Heavy North” is crumbling under the weight of its own bureaucracy.

Compare that to Georgia (5.49%) or North Carolina (4.25%). These states have found the “Sweet Spot”—the 3% to 5% range where they can maintain modern infrastructure without suffocating the citizen. They are the “Pragmatic Middle,” and they are winning the war for the suburban family.

Table 2.1: The “Pragmatic Middle” – Competitive Mid-Range States (2025-26)

| S.N. | State | Tax Rate (%) | The “Pull” Factor |

| 1 | North Carolina | 4.25% | The Tech-Research Triangle |

| 2 | Utah | 4.55% | Family-Centric Fiscal Policy |

| 3 | Arizona | 2.50% | The Semi-Conductor Influx |

| 4 | Indiana | 3.00% | Manufacturing Renaissance |

| 5 | Pennsylvania | 3.07% | The Logistics & Energy Hub |

The Bitter Truth: The “Average” US tax rate of 4.77% is a ghost. In reality, there is a massive chasm between the states that respect the dollar and the states that feel entitled to it. If your state’s rate starts with a ‘9’ or a ’10’, you aren’t a resident; you’re a donor.

The Stealth Taxes: What the Percentage Doesn’t Tell You

Don’t be fooled by a low income tax rate alone. As a strategist, I look at the Total Tax Burden. Some states are like a dishonest mechanic: they quote a low price for the oil change (Income Tax) but charge you $500 for a filter (Property and Sales Tax).

For instance, Illinois (4.95%) seems reasonable on paper. But when you factor in property taxes that feel like a second mortgage, the “Effective Tax” on your life is staggering. Conversely, states like New Hampshire (0% on wages) are honest—they only tax what you have (Interest & Dividends), not what you do (Work). This encourages productivity over passivity.

Table 2.2: The “Stealth Tax” Trap – Real Cost of Living (2025-26)

| State | Nominal Rate | The “Hidden” Bite | Impact on Future Wealth |

| Illinois | 4.95% | Record-High Property Tax | Equity Erosion |

| New Jersey | 10.75% | Highest Combined Burden | Wealth Compounding Death |

| Nebraska | 5.20% | High Agricultural/Land Tax | Generational Stagnation |

| Massachusetts | 5.00% | The “Millionaire Tax” Surcharge | Innovation Brain Drain |

The Golden Opportunity: The “Remote Work Revolution” of the early 2020s has matured. In 2026, your employer cares about your output, not your out-of-office location. Arbitraging your tax rate by moving from a 9% state to a 3% state is the single most effective “side hustle” in existence.

The Truth Behind the “Millionaire Taxes”

We see states like Massachusetts and New Jersey implementing surcharges on high earners. They call it “Fairness.” I call it “Economic Vandalism.” When you tax the person who creates 500 jobs at a rate of 10.75%, they don’t just pay the tax—they move the 500 jobs.

The psychological impact on the middle-market aspirant is profound. If you know that once you cross the $200k threshold, the state is going to take a massive bite out of every extra hour you work, you stop working those extra hours. You stop innovating. You settle. Taxation is not just a fiscal policy; it is a behavioral modifier. The states listed at the bottom of our data—the Arizona’s (2.5%) and North Dakota’s (2.5%)—understand this. They aren’t trying to “soak the rich”; they are trying to “fertilize the future.”

The Ghost of Pensions Past – Why Your Taxes Don’t Buy Your Future

Let’s stop pretending. When you look at the 10.90% in New York or the 10.75% in New Jersey, do you honestly think that money is being funneled into futuristic high-speed rail or cutting-edge schools for your children? If you do, you’re the perfect mark for a mid-century shell game.

In 2026, the grim reality is that a massive chunk of high-state taxation is nothing more than a “Debt Service Fee.” We are witnessing a generational heist where the youth of today are being taxed into oblivion to pay for the promises made to bureaucrats forty years ago. This is the Pension Black Hole, and it is the primary reason why states like Illinois (4.95%) feel like they are in a state of permanent decay despite collecting billions.

The Math of Insolvency

The “Sovereign Sunbelt” states like Texas and Florida (0%) didn’t just get lucky with the weather. They built lean, mean operational machines. Meanwhile, states in the “Rust-and-Tax Belt”—think Connecticut (6.99%) and Rhode Island (5.99%)—are carrying unfunded liabilities that exceed their annual GDP.

When a state has more retirees on the payroll than active teachers, the tax rate only has one direction to go: Up. But there is a ceiling. Once you hit the “Laffer Curve” limit, every tax hike actually decreases revenue because the people who actually pay the bills simply stop showing up.

Table 3.1: The Pension Debt Trap – Tax vs. Liability (2025-26)

| State | Tax Rate | Pension Funding Ratio | The “Hidden” Debt per Citizen |

| Illinois | 4.95% | ~40% (Critical) | $15,000+ |

| Kentucky | 4.50% | ~45% (Unstable) | $12,000+ |

| California | 13.30% | ~70% (Fragile) | $20,000+ |

| Wisconsin | 7.65% | ~100% (Solid) | $0 (The Rare Exception) |

The Bitter Truth: In high-debt states, your income tax isn’t an investment in your community. It’s a “Legacy Tax”—a payment for a party that ended before you were even born.

The “Siren Song” of the Flat Tax

Notice the trend in the “Pragmatic” states. Arizona (2.50%) and Mississippi (3.00%) have moved toward flat-tax models. Why? Because it removes the “Punishment Factor.”

In a progressive system like Minnesota (9.85%), the state treats your success as an emergency that needs to be “fixed” with a higher bracket. In a flat-tax state, the government is incentivized to help you grow. If you earn more, they get more—but your percentage stays the same. It’s a partnership, not a shake-down.

Table 3.2: The Efficiency Leaders – Best “Bang for Your Buck” (2025-26)

| S.N. | State | Tax Rate (%) | Infrastructure Quality Rank |

| 1 | Utah | 4.55% | Top 5 |

| 2 | Idaho | 5.80% | Top 10 |

| 3 | Florida | 0% | Top 15 |

| 4 | Georgia | 5.49% | Top 10 |

| 5 | Indiana | 3.00% | Top 20 |

The Golden Opportunity: Look for states where the tax rate is low but the “Funding Ratio” is high. South Dakota (0%) and Tennessee (0%) aren’t just cheap; they are fiscally solvent. They won’t surprise you with a “Wealth Surcharge” in 2028 because they don’t have a hole in their bucket.

The Psychological Break: When “Home” Becomes a “Hustle”

I’ve interviewed CEOs and small business owners from Oregon (9.90%) to Maine (7.15%). The sentiment is identical: “I love the scenery, but I hate the theft.” When the state becomes a predator, the citizen becomes a prey animal. You start looking for ways to hide income, you delay capital investments, and you eventually stop caring about the local community because you feel the community—through its government—doesn’t care about you. This is the Social Decay that data points can’t fully capture.

In 2026, the states at the top of the tax list are suffering from a “Trust Deficit.” They are betting that you are too lazy to move. They are betting that your family ties are stronger than your financial sense. But in the age of the Digital Nomad and Satellite Offices, that is a losing bet.

My Verdict for Part 3: We are seeing the rise of “Fiscal Darwinism.” The states that cannot manage their checkbooks are being cannibalized by the states that can. If you are living in a state with a funding ratio below 60%, you are essentially living in a sinking ship that is charging you for the water it’s taking on.

The Corporate Chessboard – The Great Commercial Decoupling

If you want to see where the money is going, don’t look at the residents; look at the HQ2s. In 2026, the corporate map of America has been completely redrawn. The era of the “Prestige Address” is dead. A Midtown Manhattan or Palo Alto zip code used to be a badge of honor; today, for a CFO, it’s a fiduciary liability.

The states with high income tax rates—California (13.30%) and New Jersey (10.75%)—are learning a hard lesson in “Elasticity.” Capital is like water; it finds the path of least resistance. When a state like Ohio (4.80%) or Michigan (4.25%) offers a stable, mid-range tax environment combined with lower regulatory hurdles, they don’t just steal “jobs”—they steal the entire future tax base of the coastal giants.

The “Talent Arbitrage” Strategy

Companies are no longer just moving for their own tax breaks; they are moving for yours. In the 2026 labor market, the most valuable “benefit” a company can offer isn’t a ping-pong table or free kombucha—it’s a 10% effective pay raise by simply relocating the office to a 0% tax state like Texas or Tennessee.

When a tech firm moves from San Jose to Austin, they can pay their engineers 10% less in gross salary, yet those engineers walk away with 5% more in net take-home pay because the state isn’t skimming off the top. This is the Talent Arbitrage, and it is hollowing out the “Innovation Hubs” of the 2010s.

Table 4.1: The “Corporate Migrant” – Top Destination States (2025-26)

| State | Tax Rate (%) | Top Moving Sector | Reason for Migration |

| Texas | 0% | Tech & Energy | Zero Income Tax / Low Regulation |

| Florida | 0% | Finance & FinTech | The “Wall Street South” Effect |

| North Carolina | 4.25% | BioTech | Talent Density / Low Op-Ex |

| Tennessee | 0% | Manufacturing | Logistics Hub / Zero Wage Tax |

| Georgia | 5.49% | Film & Logistics | Targeted Credits + Low Base Rate |

The Bitter Truth: The states bragging about “High Social Services” are often the ones with the highest unemployment among the youth. You can’t fund a safety net if you’ve taxed the ladder-makers out of the state.

The Small Business Slaughter

While the headlines focus on Tesla or Goldman Sachs moving, the real tragedy is happening at the $5M–$20M revenue level. These are the “Pass-Through” entities where the business income is taxed at the individual state rate.

If you own a successful family manufacturing plant in Minnesota (9.85%), the state is essentially a majority partner who doesn’t do any of the work. By the time you pay your 9.85% state tax, your federal tax, and your local property taxes, your “reinvestment fund” is decimated. Now look at South Carolina (6.20%) or Oklahoma (4.75%). That 4-5% difference is the difference between buying a new CNC machine or laying off two workers.

Table 4.2: The Small Business “Safe Havens” (2025-26)

| S.N. | State | Tax Rate (%) | Small Business Climate |

| 1 | Mississippi | 3.00% | Ultra-Low Entry Barrier |

| 2 | Alabama | 4.40% | High Industrial Support |

| 3 | South Dakota | 0% | The “No-Nonsense” Leader |

| 4 | Missouri | 4.70% | Heartland Stability |

| 5 | North Dakota | 2.50% | Energy-Backed Surplus |

The Golden Opportunity: 2026 is the year of the “Tax-Savvy Founder.” We are seeing a surge in “New-State Startups”—companies incorporated specifically in low-tax jurisdictions to maximize early-stage runway. If your state’s tax rate starts with a “7”, your startup is starting the race with a weight vest on.

The Global Perspective: America’s Internal Competition

From my vantage point as an international strategist, the most fascinating thing is that the US states are now competing more fiercely with each other than they are with foreign countries. Ireland or Singapore used to be the primary tax havens. Now, it’s Wyoming (0%).

We are seeing a “Race to the Bottom” in rates, but a “Race to the Top” in efficiency. The states that are winning—the Indiana’s (3.00%) and Arizona’s (2.50%)—have figured out that a smaller slice of a much larger, faster-growing pie is better than a huge slice of a rotting one.

The “Old Guard” states like Massachusetts (5.00%) or Maryland (5.75%) are trying to hold on by offering niche tax credits, but it’s like putting a band-aid on a gunshot wound. You can’t “credit” your way out of a fundamentally uncompetitive base rate.

My Verdict: The corporate chessboard is no longer about geography; it’s about the Bottom Line. If you are a business owner in a high-tax state, you aren’t just paying more; you are losing your ability to compete with a rival in a 0% state who has 10% more capital to spend on R&D every single year.

The Visionary End – My Verdict and the 2030 Roadmap

We have dissected the numbers, exposed the pension parasites, and mapped the corporate exodus. Now, we look toward the horizon. By 2030, the economic map of the United States will not resemble the one we grew up with. We are moving toward a “Bifurcated Union.” On one side, a group of lean, hyper-efficient “Service-State” hubs; on the other, decaying “Legacy-State” museums that function as high-tax retirement homes for a shrinking bureaucracy.

The data is an indictment of the status quo. When the average state tax rate sits at 4.77%, but the most productive states are pushing toward 0%, the “Average” is a lie. It’s a transition point. We are in the middle of a massive fiscal correction.

The 2030 Predictions: Where the Puck is Heading

-

The “Flat-Tax” Dominance: By 2030, at least 15 more states will abandon progressive brackets for a flat-tax model under 3%. They will realize that “soaking the rich” only results in a dry treasury.

-

The Death of the “Sunshine Premium”: California’s 13.30% will become unsustainable. I predict a massive federal bailout or a forced restructuring of state debt by the end of the decade as the tax base shrinks below the “critical mass” needed to service its liabilities.

-

The Rise of “Tax-Free” Tech Corridors: The area between Austin, Nashville, and Miami will become the new “Golden Triangle,” surpassing Silicon Valley in total patent filings and VC deployment.

-

The “Remote Surcharge” Wars: High-tax states will attempt to tax “out-of-state” income for remote workers. This will trigger a Supreme Court battle that will ultimately favor the worker, further accelerating the flight from New York (10.90%) and New Jersey (10.75%).

Table 5.1: The 2030 Forecast – Top Growth vs. Top Decay

| State | 2026 Rate | 2030 Outlook | Strategic Advice |

| Texas/Florida | 0% | Hyper-Congested Success | Buy Property Now |

| Arizona | 2.50% | The New Silicon Desert | Ideal for Mid-Career |

| Ohio | 4.80% | Industrial Tech Hub | Great for Manufacturing |

| California | 13.30% | Fiscal Emergency | Exit Before the “Exit Tax” |

| Illinois | 4.95% | Structural Insolvency | Avoid Long-Term Assets |

My Verdict: The most expensive mistake you can make in the next five years is Tax Inertia. If you are staying in a high-tax state out of habit, you are donating your children’s inheritance to a government that doesn’t know your name.

Table 5.2: The “Sweet Spot” Strategy – Your 2026–2030 Playbook

| Move | Target State | Benefit | The “Real” Gain |

| The Founder | Wyoming / S. Dakota | 0% Personal / Low Corp | Maximum Runway |

| The Executive | Tennessee / Nevada | 0% State Tax | $25k–$100k Annual Raise |

| The Retiree | New Hampshire | 0% Wage / Low Div | Wealth Preservation |

| The Professional | North Carolina | 4.25% Balance | Quality of Life + Growth |

Final Thoughts: The Human Factor

Beyond the tables and the percentages lies the most important metric: Liberty. A state that takes 13% of your income before you’ve even paid for your groceries is a state that believes it owns your labor. A state that takes 0% or a modest 3% is a state that acknowledges you are a free agent in a global economy.

In the 2020s, we learned we could work from anywhere. In 2026, we are learning we should live where we are treated best. The “American Dream” hasn’t disappeared; it has simply moved. It packed its bags, hopped on a southbound flight, and settled in a place where “success” isn’t a dirty word and a tax return isn’t a confession.

The truth is simple: High-tax states are the past. Low-tax states are the future. Which side of history do you want your bank account to be on?

Top 4 FAQs

1. Is the “0% State Income Tax” in places like Florida and Texas actually a scam hidden by other fees?

It’s not a scam, but it is a trade-off. While you save 5-13% on your paycheck, these states have to keep the lights on somehow. Texas has notoriously high property taxes, and Florida relies heavily on sales tax and tourism levies. However, for a high-earner, the math almost always wins: property and sales taxes are consumption-based and controllable; income tax is a mandatory penalty on your productivity.

2. If I work remotely for a California company but live in a 0% tax state like Nevada, who gets my money?

In 2026, the “Situs” of work is the ultimate battleground. Generally, you pay tax where your physical body is located. If you are a bona fide resident of Nevada, California’s 13.3% grab ends at the border. Warning: High-tax states are getting aggressive with “residency audits.” If you keep your beach house in Malibu and your heart in Vegas, the FTB (Franchise Tax Board) will hunt you down like a bounty hunter.

3. Why are some states like Arizona (2.5%) and North Dakota (2.5%) dropping their rates so low?

It’s called Economic Poaching. These states realized they can’t compete with the cultural gravity of NYC or LA, so they compete on Price. By dropping to a near-flat 2.5%, they attract the “Wealth Creators”—the engineers, the small biz owners, and the remote VPs—who are tired of being the “ATM” for mismanaged coastal budgets. It’s a land grab for the 21st-century tax base.

4. I’m a middle-class earner ($75k-$100k); does moving really make a difference for me?

Absolutely. On a $100k salary, moving from Oregon (9.9%) to Washington (0%) puts nearly $10,000 back in your pocket every single year. Over 10 years, invested at a modest 7%, that’s a $140,000 difference in your net worth. For the middle class, state tax isn’t just a bill; it’s the biggest obstacle to your retirement.