The Great American Price Trap: Why Your ZIP Code Is Now a Tax on Survival

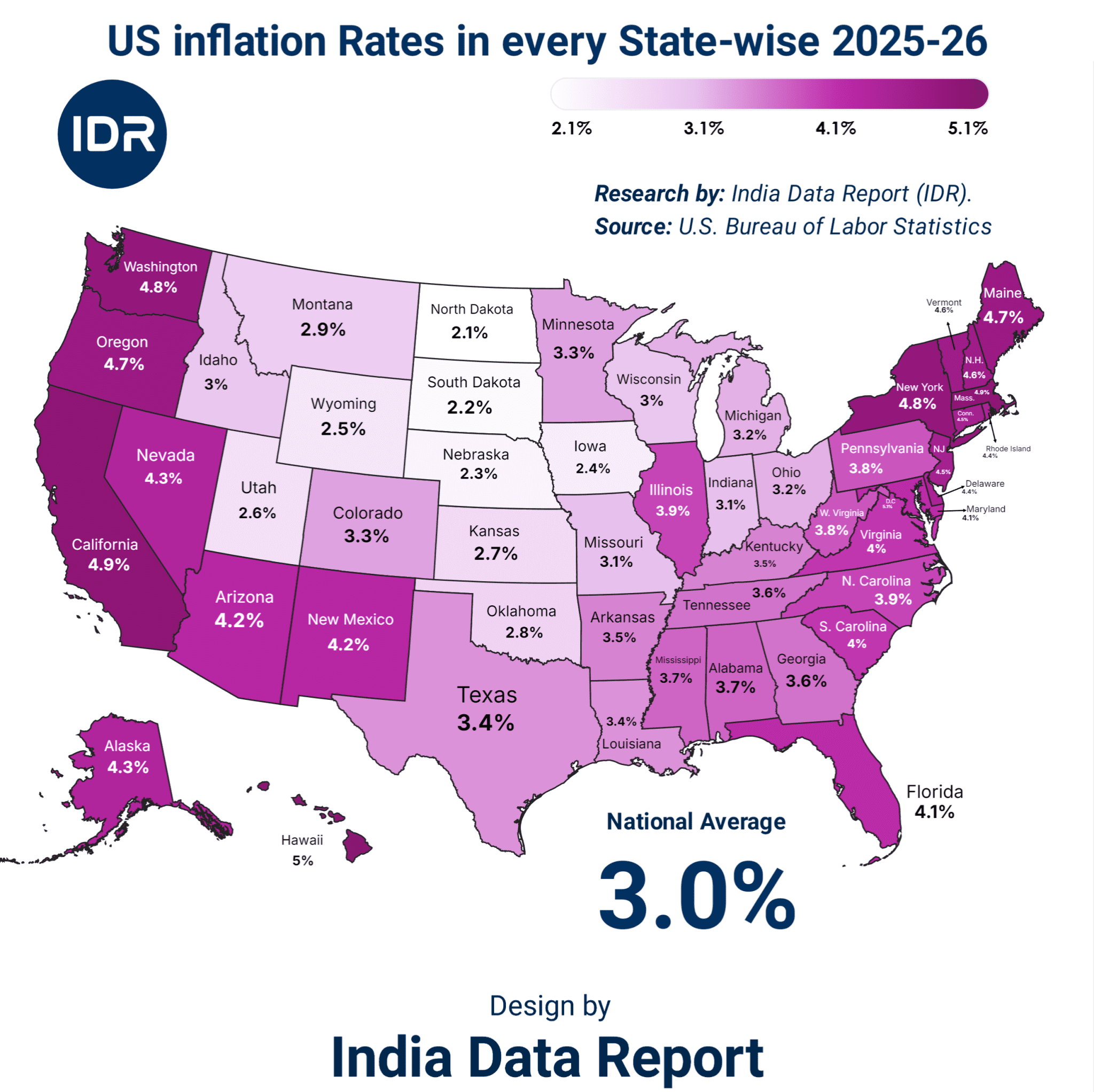

US Inflation Rates – State-wise

| Rank | State | Inflation Rate (%) |

|---|---|---|

| 1 | California | 4.9% |

| 2 | Washington | 4.8% |

| 3 | New York | 4.8% |

| 4 | Oregon | 4.7% |

| 5 | Maine | 4.7% |

| 6 | Alaska | 4.3% |

| 7 | Nevada | 4.3% |

| 8 | Arizona | 4.2% |

| 9 | New Mexico | 4.2% |

| 10 | Florida | 4.1% |

| 11 | Illinois | 3.9% |

| 12 | South Carolina | 3.9% |

| 13 | Pennsylvania | 3.8% |

| 14 | Virginia | 3.8% |

| 15 | Mississippi | 3.7% |

| 16 | Alabama | 3.7% |

| 17 | Tennessee | 3.6% |

| 18 | Georgia | 3.6% |

| 19 | Arkansas | 3.5% |

| 20 | Kentucky | 3.5% |

| 21 | Louisiana | 3.4% |

| 22 | Texas | 3.4% |

| 23 | Minnesota | 3.3% |

| 24 | Colorado | 3.3% |

| 25 | Michigan | 3.2% |

| 26 | Indiana | 3.2% |

| 27 | Missouri | 3.1% |

| 28 | Kansas | 3.1% |

| 29 | Ohio | 3.1% |

| 30 | Idaho | 3.0% |

| 31 | Wisconsin | 3.0% |

| 32 | Montana | 2.9% |

| 33 | Oklahoma | 2.8% |

| 34 | Iowa | 2.4% |

| 35 | Nebraska | 2.3% |

| 36 | South Dakota | 2.2% |

| 37 | North Dakota | 2.1% |

| 38 | Utah | 2.6% |

| 39 | Wyoming | 2.5% |

| 40 | Hawaii | 5.0% |

| 41 | North Carolina | 3.9% |

| 42 | New Jersey | 4.0% |

| 43 | Maryland | 4.1% |

| 44 | Connecticut | 4.2% |

| 45 | Massachusetts | 4.3% |

| 46 | Rhode Island | 4.4% |

| 47 | New Hampshire | 4.5% |

| 48 | Vermont | 4.6% |

| 49 | West Virginia | 3.6% |

| 50 | Delaware | 4.1% |

National Average Inflation (USA): 3.0%

The American Dream has always had a price tag, but in 2026, that tag is being rewritten daily with a red marker. If you believe the sanitized, top-down federal reports claiming a “stable” national average, you aren’t just misinformed—you are being played. While Washington bureaucrats pat themselves on the back for a 3.0% national inflation figure, the reality on the ground in Honolulu or San Francisco looks less like a “soft landing” and more like a high-speed collision with a brick wall.

Inflation is no longer a monolithic monster; it is a fragmented, geographic predator. It is a silent tax that discriminates based on where you park your car and where your kids go to school. We are witnessing the “Balkanization of Purchasing Power.”

The Illusion of the 3% Ceiling

The 3.0% national average is a statistical ghost. It is an average of extremes that serves no one but the politicians looking for a reelection soundbite. When you look at the raw, state-level data, the facade crumbles. How can a family in Hawaii, facing a staggering 5.0% surge in the cost of living, find any solace in a national average? They can’t. They are living in a different economic reality than someone in North Dakota (2.1%).

This isn’t just about “prices going up.” This is about the erosion of the middle-class soul. It’s about the father in Washington (4.8%) who skips his medication to afford the commute, and the small business owner in New York (4.8%) who realizes that despite record revenue, her margins have been incinerated by utility hikes and supply chain ghosts.

The Coastal Executioner: A Deep Dive into High-Cost States

The data reveals a brutal trend: the coasts are becoming uninhabitable for anyone without a seven-figure portfolio. Hawaii, California, and Washington are not just expensive; they are inflationary engines.

| State | Inflation Rate (%) | Real-World Impact |

| Hawaii | 5.0% | Total erosion of discretionary income; dependence on mainland imports. |

| California | 4.9% | Energy costs and regulatory “green taxes” compounding basic CPI. |

| Washington | 4.8% | Housing inventory collapse meeting high-tech wage pressure. |

| New York | 4.8% | Infrastructure decay costs being passed directly to the consumer. |

The Bitter Truth: If you live in these top-tier inflationary zones, your $100,000 salary from 2023 is effectively worth $88,000 today in terms of local purchasing power. You are running a race on a treadmill that keeps speeding up, and the “exit” sign is nowhere to be found.

The Psychology of Localized Greed

Why is Hawaii at 5.0% while Idaho sits at 3.0%? It isn’t just logistics. It’s the “Expectation Loop.” In high-inflation states, businesses expect costs to rise, so they hike prices preemptively. Consumers expect to pay more, so they stop complaining and start cutting essentials. This psychological surrender is exactly what keeps the fire burning.

We are seeing a massive internal migration—not for “better weather,” but for “economic oxygen.” The exodus from New England and the West Coast isn’t a choice; it’s a refugee flight from a currency that is melting in people’s pockets.

| State | Inflation Rate (%) | The “Hidden” Surcharge |

| Maine | 4.7% | Heating oil volatility and an aging, fixed-income population. |

| Oregon | 4.7% | Land-use laws strangling development, spiking rents. |

| Vermont | 4.6% | Small-scale supply chains unable to absorb global shocks. |

| New Hampshire | 4.5% | The “overflow” effect from Boston’s hyper-inflationary core. |

The Golden Opportunity: For the sharp investor, these disparities aren’t just “bad news”—they are a roadmap. Capital is fleeing the 5% zones and seeking refuge in the 2% “stability sanctuaries.” The question isn’t whether the US economy is healthy; the question is which version of the US economy you are trapped in.

Part 2: The Great Heartland Haven vs. The Coastal Meat Grinder

While the coastal elites are choking on a 5.0% inflation rate in Hawaii or 4.9% in California, a silent economic miracle—or perhaps a desperate defensive crouch—is happening in the American Heartland. If you look at the map, there is a “Stability Belt” stretching from North Dakota down to Oklahoma. But is this actual stability, or just the calm before a different kind of storm?

The gap between North Dakota (2.1%) and Hawaii (5.0%) is not just a 2.9% difference; it is a fundamental divergence in the American experience. In Bismarck, a dollar still feels like a dollar. In Honolulu, that same dollar feels like a suggestion.

The Low-Inflation Paradox: Why the Middle is Holding

The states at the bottom of the inflation rankings—South Dakota (2.2%), Nebraska (2.3%), and Iowa (2.4%)—share a common DNA: they produce what the world needs, not what it wants. These are the commodity kings. When you sit on top of the food and fuel supply chain, you aren’t as vulnerable to the logistics nightmares that haunt Maine (4.7%) or Rhode Island (4.4%).

However, don’t mistake low inflation for high prosperity. These states are often “low-inflation” because their local economies lack the aggressive “bid-up” pressure of high-tech hubs. It’s a survivalist’s peace.

| State | Inflation Rate (%) | The “Real” Factor |

| North Dakota | 2.1% | Energy independence and localized agricultural insulation. |

| South Dakota | 2.2% | Pro-business tax structures preventing “cost-push” inflation. |

| Nebraska | 2.3% | Stable housing market with minimal speculative bubbling. |

| Iowa | 2.4% | Food processing dominance keeping local grocery prices tethered. |

The Bitter Truth: Living in a 2% inflation state often means you are living in an economy that the “Future” has forgotten. The cost of living is low because the competition for your life is low.

The Migration of the Desperate

We are currently witnessing the largest internal migration in modern history. It’s the “Great Geographic Arbitrage.” Families are fleeing the 4.8% nightmare of Washington and Oregon for the 2.6% relative sanity of Utah and the 3.0% stability of Idaho.

But here is the catch: as people flee the high-inflation coasts, they bring their coastal wallets with them. They are “exporting” inflation. When a tech worker from Seattle moves to Boise, they don’t just bring their luggage; they bring a willingness to pay over-asking for a house, effectively nuking the local CPI. The 3.0% inflation in Idaho isn’t organic—it’s an imported contagion.

The Infrastructure of Inequality

Inflation at 4.0% and above—seen in New Jersey, Maryland, and Delaware—is often a result of “Administrative Bloat.” These states have high taxes, crumbling toll-heavy infrastructure, and massive regulatory hurdles. Every time a truck drives through New Jersey to deliver goods, the “NJ Tax” (tolls, fuel, regulations) is baked into the price of the bread on the shelf. This is “Structural Inflation,” and it is much harder to kill than “Demand-side Inflation.”

| State | Inflation Rate (%) | The Consumer’s Burden |

| New Jersey | 4.0% | High property taxes forcing landlords to spike rents. |

| Maryland | 4.1% | Proximity to DC “Gov-Spending” inflating local services. |

| Delaware | 4.1% | Logistics bottlenecks in a tiny, high-density corridor. |

| Connecticut | 4.2% | Aging utility grids driving some of the highest power bills in the US. |

The Golden Opportunity: The smart play for 2026 isn’t just “moving to a cheap state.” It’s identifying the “Resistance Zones”—states like Texas (3.4%) and North Carolina (3.9%) that are balancing explosive growth with manageable price increases. These are the battlegrounds where the future of the US economy will be decided.

The Expert’s View: We are no longer “One Nation Under God.” We are “Fifty Economies Under Stress.” If your business strategy treats the US as a single market, you are already bankrupt; you just haven’t realized it yet. You must play the map, or the map will play you.

Part 3: The Sun Belt Stagnation – Why the ‘Cheap South’ is Over

For decades, the American South was the ultimate escape hatch. If you couldn’t make it in the tax-heavy North, you moved to Florida, Georgia, or Texas. You traded your snow blower for a lawnmower and your high rent for a mortgage that didn’t feel like a monthly ransom. But look at the 2026 data. That escape hatch is slamming shut.

The Sun Belt is no longer a bargain; it is a premium. Florida is sitting at 4.1%, South Carolina at 3.9%, and North Carolina at 3.9%. This isn’t just “growth.” This is a structural transformation where the “low-cost” branding is being erased by a tidal wave of demand that the infrastructure simply cannot handle.

The Florida Fatigue: A 4.1% Reality Check

Florida used to be the land of the fixed-income retiree and the young family looking for a break. Today, it is a high-inflation furnace. When you have 4.1% inflation in a state with no income tax, the “hidden taxes”—insurance, utilities, and services—become the primary predators.

The surge in Florida isn’t driven by luxury goods; it’s driven by the “Big Three”: Insurance, Housing, and Transport. With climate-related insurance premiums skyrocketing, the cost of simply owning a roof has become a localized inflationary spiral that federal interest rates can’t touch.

| State | Inflation Rate (%) | The “Growth” Tax |

| Florida | 4.1% | Homeowners’ insurance crisis feeding directly into CPI. |

| South Carolina | 3.9% | Rapid urbanization outstripping utility and road capacity. |

| North Carolina | 3.9% | Tech-hub expansion (Raleigh/Charlotte) inflating regional rents. |

| Georgia | 3.6% | Logistics and transit costs in the Atlanta “bottleneck.” |

The Bitter Truth: The “South” as a budget-friendly destination is a myth that died in 2024. If you are moving to Florida to save money today, you are 24 months too late. You aren’t finding a deal; you’re just finding a different way to go broke.

The Psychology of the “New Normal”

In the Deep South—Alabama (3.7%), Mississippi (3.7%), and Louisiana (3.4%)—we are seeing a dangerous psychological shift. These are states with lower median incomes. When inflation stays near 4%, it doesn’t just mean “fewer vacations.” It means “food insecurity.”

The “4% Club” is where the American Dream goes to hibernate. In these regions, the gap between wage growth and price hikes is a canyon. While a software engineer in Austin (Texas, 3.4%) might absorb a 3.5% hike, a service worker in Montgomery or Jackson is being liquidated. This is the Societal Friction Point. When the basics of life—gas, eggs, electricity—outpace wages for five years straight, the “social contract” starts to fray at the edges.

| State | Inflation Rate (%) | The Human Cost |

| Alabama | 3.7% | Household debt reaching critical levels to cover basics. |

| Mississippi | 3.7% | Lowest purchasing power parity in the Southeast. |

| Tennessee | 3.6% | Nashville “Boom” driving up costs for the entire rural state. |

| Arkansas | 3.5% | Retail-heavy economy struggling with wage-price spirals. |

The “Infrastructure Debt” Inflation

Why is Texas holding at 3.4% while Florida hits 4.1%? It’s about the “Elasticity of Supply.” Texas builds. Florida is full. When a state stops building or faces geographical limits (like Hawaii’s 5.0%), inflation becomes a permanent resident.

The Sun Belt’s inflation is a symptom of its own success. We are seeing “Congestion Inflation”—where the sheer number of people trying to use the same roads, the same power grid, and the same doctors drives prices up through sheer scarcity.

The Golden Opportunity: The smart money is moving away from the “Hyped Hubs” and looking at the “Second-Tier Stabilizers.” States like Missouri (3.1%) and Kansas (3.1%) are the new frontier for those who want Sun Belt-style growth without the Coastal-style price gouging.

The Expert’s View: If you are waiting for the “National Average” to tell you when it’s safe to invest, you’ve already lost. The national average is a lie. The only truth is the local receipt. In 2026, your prosperity is determined by your ability to read the “State-Line Tax.”

Part 4: The Rust Belt Rebellion – The Surprising Resilience of the “Old Guard”

While the glitzy Sun Belt and the high-tech Coasts are drowning in a sea of red ink, the often-mocked Rust Belt is quietly staging a masterclass in economic survival. Look at the numbers: Michigan (3.2%), Ohio (3.1%), and Indiana (3.2%). These aren’t just “flyover” states anymore; they are the new bastions of American price sanity.

For decades, the narrative was that these states were “dying.” But in 2026, their “stagnation” has become their superpower. Because they didn’t experience the hyper-speculative housing bubbles of Nevada (4.3%) or Arizona (4.2%), their fall isn’t nearly as steep. They have what I call “Legacy Cushioning.”

The Manufacturing Shield: Why 3.1% is the New Gold Standard

In states like Ohio and Missouri (3.1%), the economy is built on tangible assets—factories, logistics hubs, and heavy machinery. These industries are less sensitive to the “vibecession” and speculative swings that plague the digital-heavy West Coast.

The Midwest is effectively a “Self-Sustaining Island.” When you produce your own steel, your own cars, and your own food, you don’t have to pay the “Import Premium” that is currently killing the Northeast. Maine (4.7%) and Vermont (4.6%) are at the mercy of the supply chain; Ohio and Indiana are the supply chain.

| State | Inflation Rate (%) | The Resilience Factor |

| Michigan | 3.2% | Manufacturing base absorbing wage hikes through automation. |

| Indiana | 3.2% | Lowest regulatory friction in the Great Lakes region. |

| Ohio | 3.1% | Diversified energy mix (Natural Gas + Coal) stabilizing utilities. |

| Missouri | 3.1% | Centralized logistics hub reducing “Last-Mile” transport costs. |

The Bitter Truth: The Midwest isn’t “cheap” because it’s doing well; it’s affordable because it has been ignored by the venture capital locusts that inflated the Coasts. It is the only place left in America where a middle-class salary still buys a middle-class life.

The “Infrastructure Trap” of the Northeast

Now, contrast the Rust Belt with the Northeastern corridor. Pennsylvania (3.8%) and Massachusetts (4.3%) are struggling. Why? Because they are burdened by “Ancient Infrastructure.”

In these states, every dollar of inflation is amplified by the cost of maintaining 100-year-old bridges, inefficient power grids, and a massive public sector that demands annual budget hikes to keep pace with the very inflation it helps create. It is an “Institutional Death Spiral.” When the cost of government goes up, taxes go up; when taxes go up, prices go up. Rinse and repeat.

| State | Inflation Rate (%) | The “Legacy” Cost |

| Massachusetts | 4.3% | Housing scarcity meeting a massive student/medical population. |

| Rhode Island | 4.4% | Geographic “Lock-in”—no room to build, prices must go up. |

| Pennsylvania | 3.8% | Dual-speed economy; Philly/Pittsburgh inflating while rural zones starve. |

| Maryland | 4.1% | Heavy reliance on federal spending, which is inherently inflationary. |

The Psychology of the “Rust Belt Refugee”

We are seeing a new phenomenon: the “Reverse Migration.” People who moved to the Sun Belt five years ago for “lower costs” are finding themselves priced out by 4.1% inflation and insurance premiums that look like second mortgages. They are looking back at Michigan and Ohio with new eyes.

The Rust Belt’s 3.1% inflation is a magnet for the “Squeezed Middle.” It represents a return to fundamentals. In a world where Hawaii (5.0%) is a luxury playground and California (4.9%) is a tax experiment, the Midwest is the only adult in the room.

The Golden Opportunity: If you are looking for long-term stability, look where the “Cost of Governance” is low and the “Production of Value” is high. Wisconsin (3.0%) and Kansas (3.1%) are the “Value Stocks” of the American Union. They aren’t flashy, but they won’t go bankrupt.

The Expert’s View: We are moving toward a “Two-Tier America.” Tier 1 is the High-Inflation/High-Opportunity Coasts where only the wealthy survive. Tier 2 is the Low-Inflation/High-Stability Heartland where the remaining middle class will make its last stand.

Part 5: The Visionary End – My Verdict and the 2030 Roadmap

We have dissected the data, exposed the coastal price-trap, and identified the “Stability Sanctuaries” of the Heartland. But where does this leave you? If you’re waiting for a federal “fix,” you’re waiting for a miracle that isn’t coming. Washington is obsessed with the 3.0% national average, but your life is governed by your local reality.

The next four years (2026–2030) will not be characterized by a return to the “old normal.” Instead, we are entering the era of Economic Darwinism. Only those who are geographically mobile and financially agile will survive the thinning of the middle-class herd.

My Verdict: The “State-Sovereignty” of the Dollar

The most brutal truth of 2026 is that the U.S. Dollar no longer has a uniform value. It is a regional currency. In North Dakota (2.1%), your dollar is a heavy-duty tool; in Hawaii (5.0%), it’s a melting ice cube.

We are witnessing the “Death of the National Middle Class” and the birth of “Regional Economic Tribes.” The states that are winning—Utah (2.6%), Oklahoma (2.8%), and Montana (2.9%)—are those that have decoupled themselves from global supply chain volatility and focused on local resilience.

| Prediction Category | 2026–2030 Outlook | The “Bitter Truth” |

| Migration | Mass exodus from “4% States” to “2% States.” | Home values in the Heartland will skyrocket, importing inflation there. |

| Corporate | Remote work 2.0: Companies will cut pay based on ZIP code CPI. | Your “raise” will be eaten by your state’s inability to control utility costs. |

| Lifestyle | The “Subscription-Only” life becomes mandatory in high-cost zones. | Ownership in CA/NY/HI will become a legacy privilege, not a goal. |

The Golden Opportunity: The smart play isn’t just to save money; it’s to move your capital into “Productive Anchors.” Invest in states that own their energy (Texas/Ohio) and their food (Iowa/Nebraska). Avoid states that “import” their survival (New England/Hawaii).

2027–2030: The Three Predictions

-

The Insurance Wall: By 2028, Florida (4.1%) and California (4.9%) will face an “Uninsurability Crisis.” This will trigger a secondary inflationary spike as private costs replace state services.

-

The Rise of “Micro-Hubs”: Expect a boom in cities like Des Moines, Indianapolis, and Columbus. They will become the new “Sanctuaries of Sanity,” holding inflation below 3% while the coasts burn at 5%+.

-

The Utility Rebellion: As “Green Energy” transitions hit the aging grids of the Northeast (Maine/Vermont), expect energy-driven inflation to push these states toward a permanent 4.5%+ baseline.

The Mentor’s Final Word: Stop Playing Their Game

The “National Inflation Rate” is a sedative designed to keep you from noticing that your local economy is on fire. As the old saying goes, “A small leak will sink a great ship.” Hawaii’s 5% isn’t a “leak”—it’s a hole in the hull.

You must become your own Economic Strategist. If you are living in a high-inflation state, you are effectively paying a “Location Tax” that offers no refund. It is time to stop being a victim of your geography and start being a master of it. The American Dream isn’t dead; it just moved to a cheaper ZIP code.

Sunhera Avsar (Golden Opportunity): Look at the 2.1% to 2.8% states. These are not just “low cost”—they are the high-growth engines of the next decade. Position yourself there before the rest of the world realizes the secret.

Kadhwa Sach (Bitter Truth): If you stay in a 4.5%+ state without a double-digit annual salary increase, you are choosing slow-motion poverty. No amount of “budgeting” can outrun a 5% local CPI.

The Hard Truth: Top 5 FAQs on the 2026 Inflation Crisis

1. Why is the National Inflation rate 3.0% but my bills feel like 6%?

The federal “3.0%” is a sanitized average. It’s like saying the temperature of a person with their head in an oven and feet in a freezer is “average.” High-cost states like Hawaii (5.0%) and California (4.9%) are being balanced out by the slower Heartland. If you live on the coast, the federal number is a fantasy—your local reality is far more aggressive.

2. Is moving to a “Low-Inflation” state like North Dakota actually worth it?

It’s a trade-off. While North Dakota (2.1%) preserves your purchasing power, it often lacks the wage-growth “engine” of the big cities. However, for remote workers or those in essential trades, moving from a 5% state to a 2% state is effectively an immediate 3% tax-free raise without doing a single extra hour of work.

3. Why is the South (Florida/Carolinas) no longer the “Cheap Escape”?

Supply and demand have finally broken the Sun Belt. The massive migration to states like Florida (4.1%) has triggered “Congestion Inflation.” Housing inventory is gone, and insurance premiums have become a localized tax. The “South” is now a premium brand, and you are paying the luxury markup.

4. Will these rates ever drop back to the “Old Normal” of 2%?

Not everywhere. We are seeing Structural Inflation. In the Northeast and the West Coast, high taxes and crumbling infrastructure are baked into the prices. While the “Stability Belt” (Iowa/Nebraska) may stay near 2%, the Coasts are likely entering a permanent “High-Cost Era” where 4% is the new floor.

5. What is the single biggest “Hidden Killer” in this data?

Insurance and Utilities. In high-inflation states like Maine (4.7%) and New Jersey (4.0%), these aren’t just bills; they are predators. Unlike groceries, you can’t “coupon” your way out of a 20% hike in home insurance or electricity. This is what’s liquidating the middle class in high-rank states.