The Great Indian Logistics Divide: Why 3.18 is a Warning, Not a Milestone

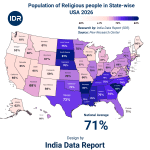

🚚 Logistics Performance Score – India (2025–26)

| S.N. | State / UT | Score (%) |

|---|---|---|

| 1 | Kerala | 98% |

| 2 | Tamil Nadu | 97% |

| 3 | Goa | 97% |

| 4 | Andhra Pradesh | 96% |

| 5 | Delhi | 96% |

| 6 | Puducherry | 96% |

| 7 | Telangana | 95% |

| 8 | Karnataka | 95% |

| 9 | Maharashtra | 94% |

| 10 | Gujarat | 94% |

| 11 | Punjab | 93% |

| 12 | Haryana | 93% |

| 13 | Himachal Pradesh | 92% |

| 14 | Uttarakhand | 92% |

| 15 | Jammu & Kashmir | 91% |

| 16 | Rajasthan | 90% |

| 17 | Dadra & Nagar Haveli and Daman & Diu (DNHDD) | 90% |

| 18 | Madhya Pradesh | 89% |

| 19 | Odisha | 88% |

| 20 | Uttar Pradesh | 87% |

| 21 | Chhattisgarh | 84% |

| 22 | Jharkhand | 83% |

| 23 | Bihar | 82% |

| 24 | Tripura | 81% |

| 25 | Assam | 79% |

| 26 | Meghalaya | 78% |

| 27 | Mizoram | 77% |

| 28 | Nagaland | 76% |

| 29 | Sikkim | 75% |

| 30 | Arunachal Pradesh | 75% |

| 31 | Lakshadweep | 74% |

| 32 | Andaman & Nicobar Islands | 73% |

| 33 | Ladakh | 72% |

| 34 | Manipur | 80% |

| 35 | West Bengal | 85% |

Average Logistics Performance Score (India): 3.18 / 5

The ivory tower economists in New Delhi are popping champagne over “incremental progress,” but if you step into the dusty warehouses of Bihar or the clogged arteries of the Northeast, the bubbles go flat pretty fast. We are staring at a national scorecard that screams a brutal truth: India is a country running at two completely different speeds. While the South and West are eyeing global supply chain dominance, the East and North-Center are still struggling to move a truck without it becoming a week-long odyssey.

Let’s be blunt. An Average Logistics Performance Score of 3.18 out of 5 is not a badge of honor. It is a “C grade” in a world where China, Germany, and Singapore are scoring straight A’s. We are talking about the difference between becoming a global manufacturing hub and remaining a “promise” that never quite delivers. The 2025–26 data isn’t just a list of percentages; it’s a map of economic inequality. When Kerala hits 98% and Ladakh languishes at 72%, we aren’t just looking at geography—we are looking at a systemic failure to bridge the gap between the “digital expressway” and the “potholed reality.”

The Illusion of National Progress

The government loves to talk about the PM Gati Shakti and the National Logistics Policy. On paper, they are masterpieces. In reality? The friction is killing us. Every hour a truck sits idle at a state border or a poorly managed toll plaza, the “Make in India” dream bleeds cash. We are burning roughly 13-14% of our GDP on logistics costs, while our global competitors have hacked that down to 7-8%. That 6% gap is the “hidden tax” every Indian citizen pays on everything from a sack of rice to a smartphone.

Look at the top of the ladder. Kerala (98%) and Tamil Nadu (97%) aren’t just lucky; they’ve integrated their ports with their hinterlands with a surgical precision that the rest of the country seems to find “too complex.” They’ve understood that logistics isn’t about building a road; it’s about the data flowing over that road. Meanwhile, the bottom of the list is a graveyard of logistical intent.

Table 1: The Champions of the Corridor (Top Tier)

| State / UT | Score (%) | Primary Driver | Efficiency Rank |

| Kerala | 98% | Multimodal Port Integration | 1 |

| Tamil Nadu | 97% | Industrial Cluster Connectivity | 2 |

| Goa | 97% | Export-Oriented Last Mile | 3 |

| Andhra Pradesh | 96% | Digital Transit Clearing | 4 |

| Delhi | 96% | Hub-and-Spoke Maturity | 5 |

(The Golden Opportunity): The states scoring above 95% are no longer competing with Uttar Pradesh or Bihar; they are competing with Vietnam and Thailand. Investors aren’t looking at “India” as a whole anymore; they are cherry-picking these high-performers for their next billion-dollar factory.

The Human Cost of Efficiency Gaps

We talk about “scores,” but let’s talk about the warehouse manager in West Bengal (85%) who watches inventory rot because the “last mile” is actually a “last marathon.” Or the entrepreneur in Manipur (80%) who pays triple the freight cost of someone in Maharashtra (94%). This isn’t just an economic metric; it’s a psychological barrier. When a business owner in the Northeast realizes that shipping a product to Delhi is more expensive than shipping it from Dubai to Mumbai, the “will to scale” dies a quiet death.

The data shows a terrifying plateau. We’ve picked the low-hanging fruit—the national highways are better, yes—but the “soft infrastructure” (the bureaucracy, the lack of standardized palletization, the archaic state-level permits) is where the rot remains. We are trying to run a Tesla-speed economy on a bullock-cart regulatory framework.

Table 2: The Red Zone (The Bottom Tier Reality)

| State / UT | Score (%) | The Bottleneck | Economic Impact |

| Ladakh | 72% | Terrain & Seasonal Blackouts | Critical |

| A&N Islands | 73% | Transshipment Lag | High |

| Lakshadweep | 74% | Infrastructure Vacuum | Moderate |

| Sikkim | 75% | Single-Artery Dependency | High |

| Nagaland | 76% | Regulatory & Security Friction | Severe |

(The Bitter Truth): The gap between 98% and 72% is an economic canyon. If you are a startup in the bottom 10 states, you are essentially handicapped from day one. Without a radical “Logistics Equalization” fund, these regions will remain nothing more than consumption markets for the products made in the South and West.

The 3.18 average is a mask. It hides the brilliance of the leaders and the despair of the laggards. If India wants to reach a $5 trillion or $10 trillion economy, we can’t have states failing the basic test of moving goods. The clock is ticking toward 2030, and right now, our engine is misfiring.

The Cannibalization of Commerce – Why the “Middle Class” of States is Stagnating

If the top-tier states are the engines and the bottom-tier are the anchors, then the “middle-of-the-pack” states—the likes of Maharashtra (94%), Gujarat (94%), and Punjab (93%)—are where the real drama of Indian logistics is unfolding. On paper, these should be the undisputed leaders. They have the coastlines, the industrial heritage, and the political clout. Yet, they are being outpaced by the agility of the Southern corridor. Why? Because they are falling into the trap of Logistical Arrogance.

For decades, Gujarat and Maharashtra didn’t have to try; geography did the work for them. But in 2026, geography is being defeated by technology. While a port in Gujarat might have massive capacity, the “internal friction”—the time it takes for a container to clear the yard and hit the highway—is being challenged by the automated, frictionless ecosystems being built in places like Andhra Pradesh and Tamil Nadu. We are witnessing a shift where “size” is being slaughtered by “speed.”

The “90% Trap”: Efficiency vs. Bureaucracy

Look at the numbers. Rajasthan (90%) and Madhya Pradesh (89%) are hovering at the edge of excellence, but they can’t seem to break through the glass ceiling. This isn’t a problem of asphalt; it’s a problem of “Human Friction.” In these states, the “Checkpost Culture” hasn’t fully died—it has just migrated online. Digital permits that should take seconds still get stuck in “pending” status due to manual overrides.

The psychological impact on a fleet owner is massive. Greed and inefficiency at the local level act as a localized inflation. When a driver knows he might face “unexplained delays” in Uttar Pradesh (87%), he pads his quote. That 10-15% “risk premium” is what keeps these states from becoming true logistics hubs. They are participating in the race, but they are running with weights tied to their ankles.

Table 3: The Efficiency Leak – The “90% Club” Analysis

| State | Score (%) | The “Hidden” Friction | Resulting Cost Increase |

| Maharashtra | 94% | Urban Congestion & Port Exit Lag | 8-10% |

| Gujarat | 94% | Last-Mile Connectivity Gaps | 7-9% |

| Punjab | 93% | Seasonality & Storage Volatility | 12% |

| Rajasthan | 90% | Interstate Transit Complexity | 15% |

| Madhya Pradesh | 89% | Warehouse Tech Adoption Lag | 11% |

(The Bitter Truth): Having a 94% score is a failure for a state with the resources of Maharashtra. It indicates that the “Legacy System” is fighting against modern reform. If these states don’t innovate, they will become the “rust belt” of India by 2030.

The Data vs. The Ground Reality: The 3.18 Paradox

The national average of 3.18/5 is a statistical sedative. It makes the laggards feel like they aren’t “that far behind” and the leaders feel like they’ve won. But in global trade, there is no “participation trophy.”

Consider the “Information Asymmetry.” A giant like Amazon or Reliance has the data to bypass these inefficiencies. They build their own captive logistics. But what about the SME (Small and Medium Enterprise) in Odisha (88%) or Chhattisgarh (84%)? They are at the mercy of the public infrastructure. When the public system scores a 3.18, the small businessman pays the price in lost margins. We are creating a “Logistics Divide” where only the wealthy can afford to be efficient.

Table 4: The SME Handicap – Logistics Cost as % of Revenue

| Region Performance | Avg. Logistics Cost (SME) | Market Reach | Growth Potential |

| Top Tier (95%+) | 6-8% | Global / Pan-India | Exponential |

| Mid Tier (85-94%) | 12-15% | Regional / Limited | Linear |

| Low Tier (<85%) | 20%+ | Localized Only | Stagnant |

(The Golden Opportunity): For states like West Bengal (85%), there is a massive opportunity to leapfrog. By skipping the “incremental road repair” phase and going straight to “AI-driven traffic management” and “integrated cold chains,” they can steal the thunder from the complacent leaders.

The Psychology of the “Empty Truck”

The most damning data point in Indian logistics isn’t the speed of the truck; it’s the “Return Load.” In states like Bihar (82%) and Jharkhand (83%), trucks arrive full of finished goods and leave empty. Why? Because the local production ecosystem is disconnected from the logistics network.

This “one-way logistics” doubles the cost for the local consumer. It is a cycle of poverty disguised as a transport issue. Until we see these scores rising in the East, India’s claim of being a “homogenous market” is a myth. We are a collection of economic islands, separated by a sea of logistical incompetence.

The North-South Geopolitical Schism – A Manufacturing War Won by Kilometers

If you want to know where the “New India” is being built, stop looking at political rallies and start looking at the speed of a freight train. The data reveals a terrifying geopolitical reality: the Vindhyas have become a logistical Great Wall. The South and West are effectively operating as a First-World economic bloc, while the North and East are trapped in a developing-world struggle.

When Tamil Nadu (97%) and Karnataka (95%) command the scores they do, they aren’t just moving boxes; they are sucking the oxygen out of the room for states like Uttar Pradesh (87%) and Bihar (82%). Capital is cowardly—it goes where it is treated best. In the global “China Plus One” strategy, an investor doesn’t just look at India; they look at the 48-hour window. If you can’t get a component from a factory to a port in 48 hours, you don’t exist. This is the “Logistical Darwinism” that is deciding the fate of millions of jobs.

The “Distance Tax” and the Death of Northern Ambition

The North is fighting a war against geography that it is currently losing. Being landlocked is a challenge, but being landlocked with a 87-90% performance score is a catastrophe. Haryana (93%) is the only northern outlier, primarily because it has hitched its wagon to the Delhi (96%) hub-and-spoke model.

But look at Uttarakhand (92%) and Himachal Pradesh (92%). They have high scores, yet their industrial growth is stunted. Why? Because logistics isn’t just about efficiency; it’s about connectivity. A 92% score on a mountain road that gets blocked by a single landslide is a “paper victory.” The lack of “Resilient Infrastructure” means that for every step forward these states take, the “Last Mile” drags them two steps back.

Table 5: The Connectivity Gap – Time to Major Port

| State | Performance Score | Avg. Lead Time (Hours) | Reliability Index |

| Tamil Nadu | 97% | 4 – 8 Hours | 99% |

| Maharashtra | 94% | 12 – 18 Hours | 92% |

| Uttar Pradesh | 87% | 60 – 72 Hours | 74% |

| Bihar | 82% | 80+ Hours | 65% |

| Assam | 79% | 120+ Hours | 58% |

(The Bitter Truth): A manufacturer in Bihar starts the race 72 hours behind a competitor in Chennai. That isn’t a “gap”; it’s a different century. Until the Dedicated Freight Corridors (DFC) become a living reality—not just a PR talking point—the North will continue to export people and import poverty.

The Psychological Warfare of “Logistics Clusters”

We see a fascinating phenomenon in Telangana (95%) and Andhra Pradesh (96%). They have mastered the “Cluster Psychology.” They don’t just build a road to a factory; they build an ecosystem where the supplier, the manufacturer, and the packer are within a 5-km radius. This “Logistics Density” is the secret sauce.

Contrast this with Odisha (88%) or West Bengal (85%). They have the minerals, the ports, and the labor. But they lack the integrated soul. Their logistics are fragmented. The miner doesn’t talk to the transporter, and the transporter doesn’t trust the port authority. This “Trust Deficit” is the invisible friction that burns through the 3.18 national average.

Table 6: The “Trust Deficit” – Administrative Friction Points

| State Category | Avg. Stops per 100km | Digital vs. Manual Clearance | Logistics “Corruption” Index |

| The Elite (95%+) | 0.8 | 98% Digital | Low |

| The Strugglers (85-90%) | 2.4 | 65% Digital | Medium-High |

| The Crisis Zone (<85%) | 4.5+ | 40% Digital | High |

(The Golden Opportunity): The “Digital Rebranding” of the East is the only way out. If Jharkhand (83%) or Chhattisgarh (84%) can implement a “Zero-Stop” policy for freight, they could theoretically bypass their geographical disadvantages. But that requires political will—a commodity rarer than lithium.

The 2030 Vision: Two Indias or One?

The current trajectory is leading us toward a “Two-Speed India.” If the Southern and Western states continue to hover in the 95-98% range while the “Hindi Heartland” remains stuck in the high 80s, we will see an unprecedented internal migration of capital.

We are not just moving goods; we are moving the future. The 3.18 score is a scream for help from the inland states. It tells us that while the “Global India” is flying, the “Heartland India” is still trying to find the keys to the truck.

The Digital Ghost in the Machine – AI, 5G, and the New “Data Aristocracy”

As we approach the 2026-2030 horizon, a new and invisible wall is being built. It’s no longer just about who has the widest highways; it’s about who owns the “Logistics Intelligence.” While the national average of 3.18/5 suggests a slow crawl toward progress, the “Data Aristocracy” in states like Karnataka (95%) and Delhi (96%) is already playing a different game. They are moving from “Reactive Logistics” (fixing a broken truck) to “Predictive Logistics” (knowing the truck will break before the driver does).

But here is the sting: This digital revolution is widening the gap, not closing it. The 5G rollout isn’t happening in the warehouses of Tripura (81%) or Nagaland (76%). It’s concentrated in the golden corridors. We are entering an era where a warehouse in Tamil Nadu (97%) uses AI to optimize every square inch of space, while a warehouse in Bihar (82%) still relies on a man with a register and a flickering tube light. This is not just a technology gap; it’s an Efficiency Apartheid.

The “Algorithm Tax” on the Unprepared

In the next three years, the “Algorithm” will decide which states win. E-commerce giants and global shipping lines are now using AI-driven “Route Optimization” that actively penalizes states with low reliability. If your state has a history of “unexplained delays” or high “administrative friction” (like West Bengal at 85%), the algorithm simply marks it as a “High-Risk Zone.”

The result? Logistics companies charge a “Risk Premium” to enter these states. The consumer in Assam (79%) ends up paying for the inefficiency of their state’s infrastructure every time they click “Buy Now.” The digital ghost in the machine is quietly sucking wealth out of the laggard states and depositing it into the coffers of the elite.

Table 7: The Digital Maturity Index (DMI) vs. Performance

| State / Region | 5G/IoT Integration | AI-Route Adoption | Digital Literacy (Logistics) |

| The Digital Elite (South) | 92% | High | 88% |

| The Urban Hubs (West/NCR) | 85% | Medium-High | 82% |

| The Industrial Belt (East) | 34% | Low | 41% |

| The Frontier (NE/Islands) | 12% | Negligible | 19% |

(The Bitter Truth): Technology is a multiplier. If your base efficiency is 98% (Kerala), AI makes you 120% efficient. If your base is 75% (Arunachal), AI just highlights how much you’re failing. Without a “Digital Minimum Support Price” for infrastructure, the East is doomed to be a digital colony.

The Human Element: Greed, Fear, and the “Smart” Warehouse

Let’s get real about the “Smart Warehouse.” It sounds clinical, but it’s driven by the most basic human emotion: Fear. Fear of losing inventory, fear of labor strikes, and fear of time. In states like Maharashtra (94%) and Gujarat (94%), the transition to robotics is being fueled by a desire to “de-risk” from human volatility.

However, in states like Uttar Pradesh (87%) and Odisha (88%), the logistics sector is still one of the biggest employers of low-skilled labor. When the “Smart Warehouse” arrives, it won’t bring jobs; it will bring displacement. The 3.18 score is a warning that we are not training our workforce for the 2030 reality. We are building 21st-century roads but using 19th-century mindsets to manage them.

Table 8: The Labor vs. Automation Conflict

| State Score Range | Automation Potential | Job Displacement Risk | Skill Gap Index |

| Top Tier (95%+) | 75% | High | Low (Transitioning) |

| Mid Tier (85-94%) | 45% | Moderate | High |

| Low Tier (<85%) | 15% | Low (For Now) | Critical |

(The Golden Opportunity): States like Rajasthan (90%) and Madhya Pradesh (89%) have a “Late-Mover Advantage.” They can skip the intermediate, semi-automated phase and build “Greenfield Smart Hubs” that are 100% 5G-ready from day one. But this requires kicking the “Babu-culture” out of the warehouse.

The Shadow of 2030: Predicting the “Black Swan”

What happens when the global supply chain shifts to “Just-in-Case” instead of “Just-in-Time”? The states that will survive are those with Resilience. Puducherry (96%) and Goa (97%) have shown that being small and agile is a massive advantage in a volatile world.

The “Black Swan” event for Indian logistics won’t be a fuel price hike; it will be a “Cyber-Gridlock.” If a state’s logistics data is hacked or if the digital clearing system fails, the states with a 3.18 average will collapse into chaos. The leaders are already building “Cyber-Resilient” corridors. The rest are still trying to figure out why their website won’t load.

The Visionary Verdict – 2030 Predictions and the “Bitter Pill”

The numbers have been crunched, the digital ghosts exposed, and the geographical divides laid bare. Now, we move beyond the spreadsheets. As a Senior Economic Strategist, I don’t care about what happened yesterday; I care about who survives tomorrow. The 3.18 national average is a “poverty trap” disguised as a statistic. If we stay at this level, India will be a nation of consumers for the world, not the factory of the world.

To break the 4.0 barrier, we need to stop treating logistics as a “transportation problem” and start treating it as a “National Security Priority.” When a truck carrying semiconductors from Chennai to Gurgaon takes longer than a ship from Shanghai to Los Angeles, that is a security failure.

My Verdict: The 2026–2030 Predictions

-

The Rise of “Sovereign Logistics Zones”: By 2028, the top-performing states like Tamil Nadu, Kerala, and Andhra Pradesh will stop waiting for national reforms. They will create “Sovereign Logistics Corridors” with their own digital laws, custom clearances, and 5G-mesh networks. They will effectively “secede” logistically from the rest of the country to maintain their global scores.

-

The Death of the “General Transporter”: Small, unorganized trucking companies in the 80% score zones (Bihar, Jharkhand, Assam) will be wiped out by AI-driven conglomerates. If you don’t own the data, you don’t own the route. By 2030, 70% of India’s freight will be managed by just five “Data Giants.”

-

The “Reverse Migration” of Industry: We will see a massive exodus of manufacturing from high-cost, high-friction states like West Bengal (85%) and Uttar Pradesh (87%) toward the “Efficiency Elite.” The heartland will become a “Logistics Desert” unless they implement a radical, zero-tolerance policy against administrative corruption.

Table 9: The 2030 Projection – The Winners and Losers

| State Category | Current Score | 2030 Projected Score | Economic Status |

| The Global Hubs | 95-98% | 99.2% | Manufacturing Superstars |

| The Aspirants | 90-94% | 95.5% | Domestic Giants |

| The Stagnant | 80-89% | 84.0% | Consumption Markets |

| The Neglected | <80% | 78.0% | Economic Dependencies |

(The Golden Opportunity): For the “Stagnant” states, the only way out is “Hyper-Specialization.” If Odisha (88%) becomes the world’s most efficient mineral logistics hub, or Punjab (93%) becomes the undisputed cold-chain leader, they can beat the average. Trying to do everything is a recipe for doing nothing.

The Bitter Pill: What No One Wants to Hear

We can build all the roads we want, but if the “Inspector Raj” survives in the shadows of the toll booth, we are finished. The real bottleneck isn’t the engine; it’s the hand on the throat of the driver. To hit a 4.5/5 score, India must:

-

Abolish Physical Checkpoints: 100% digital, 0% physical. Any manual stop should be treated as a systemic failure.

-

Logistics Privatization: Hand over the management of freight corridors to private consortia with “Performance-Linked Penalties.” If the goods are late, the manager pays.

-

The “One-Nation, One-Grid” for Data: A unified, blockchain-backed ledger for every piece of cargo in the country. No more “lost” files or “pending” permits.

Table 10: The “Bitter Pill” Reform Impact

| Reform Measure | Cost of Implementation | 2-Year ROI | Political Difficulty |

| Total Digital Clearing | Moderate | 400% | High (Vested Interests) |

| Privatized Corridors | Low | 250% | Extreme (Ideological) |

| Unified Data Ledger | High | 600% | Moderate (Technical) |

(The Bitter Truth): We are addicted to the “3.18” because it allows for excuses. Excellence is demanding; it requires firing the incompetent and bypassing the corrupt. Are we ready for that? Or are we happy being “almost good”?

The Final Call to Action (CTA)

The data is out. The map is drawn. If you are an investor, you know where to put your money. If you are a policymaker in a “Red Zone” state, the clock is screaming. 2030 isn’t a distant dream; it’s the next quarter.

Stop building roads. Start building trust.

India’s logistics performance isn’t just a number; it’s our destiny. We either become the world’s conveyor belt, or we become its junkyard. The choice, quite literally, is in the “last mile.”

Logistics Performance Index (2025–26): Key FAQs

Q1. Why is India’s average score of 3.18/5 considered low?

The 3.18 score masks a massive “Logistics Divide.” While states like Kerala and Tamil Nadu are performing at global standards (97%+), landlocked and northeastern states are dragging the average down due to poor infrastructure and high administrative friction. A 3.18 average indicates that India is still twice as expensive in moving goods compared to global competitors like Germany or Singapore.

Q2. How does a poor logistics score affect the common citizen?

It acts as a “hidden tax.” High logistics costs (currently 13–14% of GDP) make every essential item—from vegetables to electronics—more expensive. In states with lower scores, inefficient transport and “checkpost delays” lead to supply chain wastage, the cost of which is ultimately passed on to the consumer.

Q3. Can the Dedicated Freight Corridors (DFC) fix the national average?

The DFC is a game-changer for speed between major hubs, but it doesn’t solve the “Last-Mile” problem. Even if a train moves cargo at 100 km/h, the efficiency is lost if the goods are stuck in urban congestion or outdated warehouses for the final 20 kilometers. Real improvement requires a “Smart Warehouse” revolution across all states.

Q4. What is the one radical change needed to reach a 4.5/5 score by 2030?

The absolute abolition of physical checkpoints. To reach world-class efficiency, India must move to a 100% digital, blockchain-backed clearance system. Any manual stop for a freight vehicle should be treated as a systemic failure. Until we remove the “human friction” from the highway, the 3.18 plateau will be hard to break.

Data Source

- DPIIT (LEADS 2024-25)

- Ministry of Commerce

- Economic Survey 2025-26

- Mordor Intelligence.