The Great Indian Land Grab: Why Your “Safe Haven” Assets are Under Siege

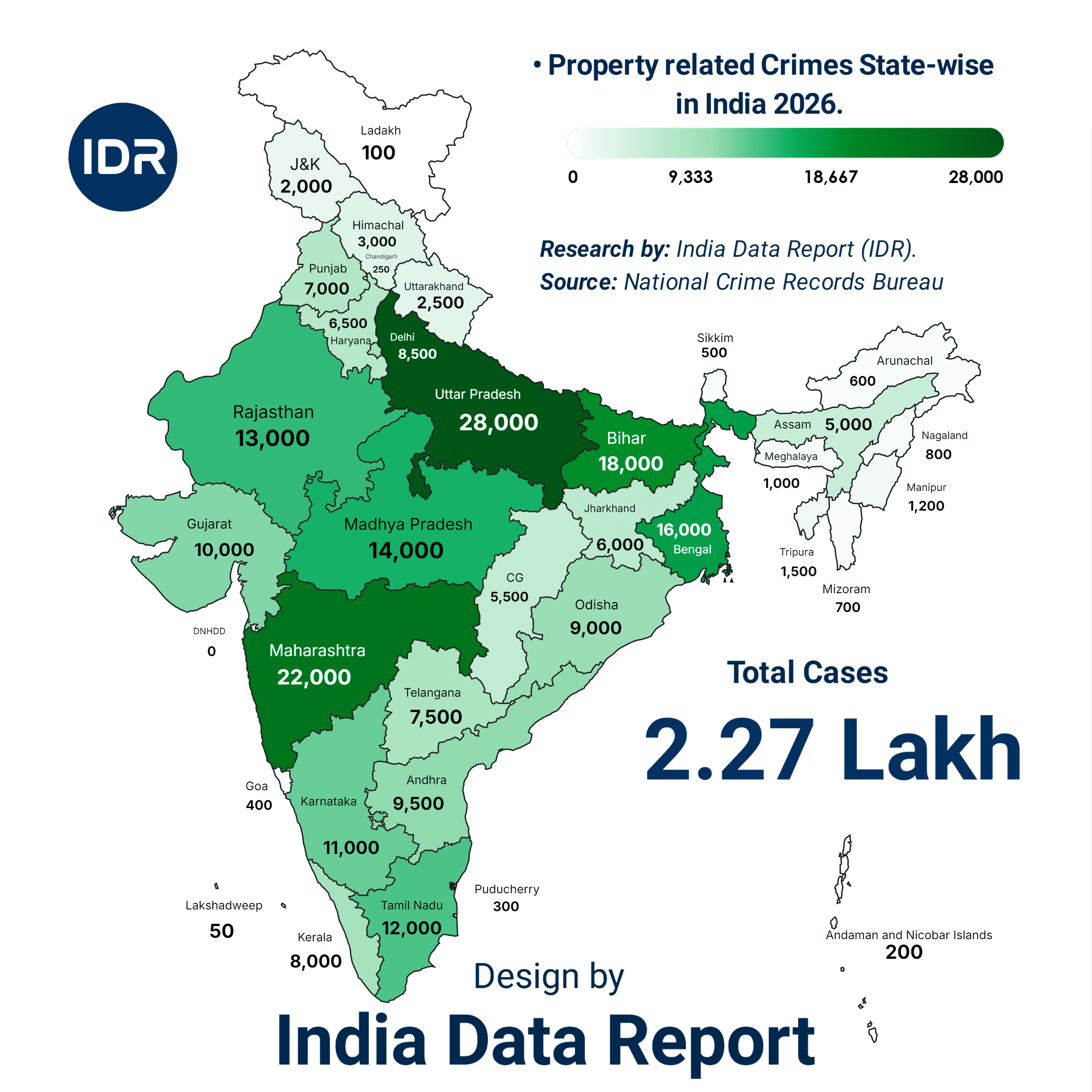

🏠 Property-Related Crimes – India (2026)

| S.N. | State / UT | Cases |

|---|---|---|

| 1 | Uttar Pradesh | 28,000 |

| 2 | Maharashtra | 22,000 |

| 3 | Bihar | 18,000 |

| 4 | West Bengal | 16,000 |

| 5 | Madhya Pradesh | 14,000 |

| 6 | Rajasthan | 13,000 |

| 7 | Tamil Nadu | 12,000 |

| 8 | Karnataka | 11,000 |

| 9 | Gujarat | 10,000 |

| 10 | Andhra Pradesh | 9,500 |

| 11 | Odisha | 9,000 |

| 12 | Delhi | 8,500 |

| 13 | Kerala | 8,000 |

| 14 | Telangana | 7,500 |

| 15 | Punjab | 7,000 |

| 16 | Haryana | 6,500 |

| 17 | Jharkhand | 6,000 |

| 18 | Chhattisgarh | 5,500 |

| 19 | Assam | 5,000 |

| 20 | Himachal Pradesh | 3,000 |

| 21 | Uttarakhand | 2,500 |

| 22 | Jammu & Kashmir | 2,000 |

| 23 | Tripura | 1,500 |

| 24 | Manipur | 1,200 |

| 25 | Meghalaya | 1,000 |

| 26 | Nagaland | 800 |

| 27 | Mizoram | 700 |

| 28 | Arunachal Pradesh | 600 |

| 29 | Sikkim | 500 |

| 30 | Goa | 400 |

| 31 | Puducherry | 300 |

| 32 | Andaman & Nicobar Islands | 200 |

| 33 | Ladakh | 100 |

| 34 | Lakshadweep | 50 |

| 35 | Dadra & Nagar Haveli and Daman & Diu (DNHDD) | 0 |

Total Property-related Crime Cases (India): ~2.27 Lakh

The Indian middle class is obsessed with two things: gold and soil. But as we stand in February 2026, the soil is shifting beneath our feet. While you were busy tracking Sensex highs, a silent, predatory epidemic has hollowed out the very definition of “ownership.” We aren’t just talking about petty theft or a broken window; we are witnessing the systematic weaponization of property records.

If you think your registry papers make you the master of your plot, you are living in a fool’s paradise. In a country where litigation outlives the litigants, land has become the ultimate frontier for organized crime.

The Mirage of Ownership: 2.27 Lakh Red Flags

Let’s stop sugarcoating the reality. The latest data for 2026 is a bloodbath for the “real estate as a safe investment” narrative. With approximately 2.27 lakh reported property crimes across the nation, the infrastructure of trust has collapsed. But here is the kicker: these are only the reported cases. For every FIR filed in a UP thana or a Mumbai police station, there are ten elderly couples being bullied out of their ancestral homes by local land mafias who have better ties with the registrar’s office than you do with your neighbor.

Uttar Pradesh leads the pack not just because of its size, but because of its complexity. 28,000 cases isn’t just a statistic; it’s a symptom of a systemic failure where digital records are being bypassed by manual muscle. Maharashtra follows closely at 22,000, proving that even “developed” urban hubs are playgrounds for sophisticated white-collar land sharks.

Table 1: The Top 10 High-Risk Zones (2026 Data)

| State | Reported Property Crimes | Economic Vulnerability Index |

| Uttar Pradesh | 28,000 | Critical |

| Maharashtra | 22,000 | High (Urban Hubs) |

| Bihar | 18,000 | Severe (Rural/Land) |

| West Bengal | 16,000 | Volatile |

| Madhya Pradesh | 14,000 | Moderate-High |

| Rajasthan | 13,000 | Rising |

| Tamil Nadu | 12,000 | Institutional Risk |

| Karnataka | 11,000 | Tech-Fraud Heavy |

| Gujarat | 10,000 | Industrial/Encroachment |

| Andhra Pradesh | 9,500 | Legal Gridlock |

The Bitter Truth: In 2026, a property “title” is often nothing more than an invitation to a thirty-year legal battle. If your land is vacant, it isn’t yours; it’s a target.

Psychological Warfare: Fear, Greed, and the “Paper” Trap

Why do we keep falling for it? Because the “Land is the best investment” mantra is hardwired into our DNA. We ignore the stench of corruption because we are blinded by the 15% annual appreciation. But look at the psychology of the criminal in 2026. They don’t need a gun; they need a stamp.

The modus operandi has shifted from physical encroachment to Identity Hijacking. Fraudsters are now using AI-generated deepfakes to impersonate NRIs at registry offices, selling properties that the actual owners haven’t visited in years. By the time the real owner lands at Indira Gandhi International Airport, their “Safe Haven” has already been sold twice over to “bona fide” buyers.

The middle class is caught in a pincer movement. On one side is the greed of quick returns; on the other is the paralyzing fear of the “Land Mafia.” This isn’t just crime; it’s an economic tax on the honest citizen. When 2.27 lakh cases clog our courts, the “Rule of Law” becomes a “Rule of Whoever-Has-The-Best-Connects.”

Table 2: Crime Type Distribution (Estimate 2026)

| Crime Category | Impact Level | Primary Victim Demographic |

| Document Forgery | Catastrophic | NRIs & Senior Citizens |

| Illegal Encroachment | High | Rural & Periphery Landowners |

| Double Selling | Severe | Middle-class Flat Buyers |

| Benami Transfers | Institutional | High Net Worth Individuals |

| Tech-Based Record Tampering | Rising | Urban Digital Investors |

Golden Opportunity: The only winners in this chaos are the specialized “Title Verification” firms and legal consultants who charge a premium to tell you what the government should have guaranteed for free: that your house is actually yours.

The “Silent” States: A False Sense of Security?

Look at the bottom of the list. Lakshadweep (50 cases) and Ladakh (100 cases). Is it because their systems are perfect? No. It’s because the market isn’t “hot” enough for the sharks—yet. But as tourism and infrastructure projects push into these frontiers, watch these numbers explode.

In the corridors of power, they talk about “Ease of Doing Business.” But for the man on the street, there is no “Ease of Owning Property.” We have built a 5-trillion-dollar dream on a foundation of disputed survey numbers and forged power-of-attorney documents. It’s like building a skyscraper on a swamp.

The question isn’t whether your property is at risk. The question is: who is currently holding a fake set of keys to your front door?

The Digital Guillotine: Why Blockchain and Biometrics are Failing You

We were promised a revolution. When the government screamed “Digital India” from the rooftops, the urban elite let out a collective sigh of relief. We thought the days of the pot-bellied clerk hiding files in a dusty basement were over. But here is the cold, hard reality of 2026: The digital transition hasn’t eliminated the Land Mafia; it has simply upgraded their toolkit.

The 2.27 lakh cases we see today aren’t just remnants of the old world. A massive chunk of the property fraud in states like Karnataka and Telangana—our “Silicon Valleys”—now involves Electronic Record Tampering. If you can hack a bank, you can certainly manipulate a poorly secured municipal database. The predator of 2026 doesn’t carry a lathi; he carries a laptop and a deep understanding of database vulnerabilities.

The “Verified” Lie: How Digital Records are Spoofed

The psychological blow of a digital fraud is far more devastating than a physical encroachment. When a local goon occupies your plot, you can see him. You can call the police. You can fight. But when your name is silently deleted from the digital Bhoomi or Anyror records, you are fighting a ghost.

The bureaucracy has mastered the art of “Plausible Deniability.” If a record is “missing” or “overwritten,” they blame the server, not the bribe. This has created a new class of victims: the Tech-Savvy Ignorant. These are people who checked their records online six months ago, saw their name, and went back to sleep, unaware that a “Backdoor Entry” in the system was being sold for a few lakhs in a shady backroom.

Table 3: Digital vs. Physical Property Risk (2026)

| Risk Factor | Physical Encroachment | Digital Record Fraud |

| Detection Speed | Immediate (If you visit) | Delayed (Months or Years) |

| Complexity to Resolve | High (Physical/Police) | Extreme (Legal/Forensic) |

| Cost of Reclaiming | Moderate (Legal Fees) | Prohibitive (Expert + Legal) |

| State Sensitivity | High (UP, Bihar) | High (Karnataka, MH, Delhi) |

| Success Rate of Recovery | 40% | Less than 15% |

The Bitter Truth: Your digital “7/12 extract” or “Patta” is only as secure as the lowest-paid contractual employee at the data center. In 2026, the password to your life’s savings is often “Admin123.”

The “Middle-Class Trap”: Flats, RERA, and the Great Disappointment

Let’s talk about the city-dweller. You thought you were safe because you bought a flat in a gated community with a “RERA Approved” badge. Look at the numbers for Maharashtra (22,000) and Delhi (8,500). A staggering percentage of these involve Undisclosed Litigated Land.

Developers in 2026 have become master illusionists. They build on land that has “Clouded Titles”—meaning there’s a cousin in a village three generations ago who still has a legal claim. The developer takes your money, builds the shell, and then the courts stay the project. You are left paying an EMI for a pile of bricks you can never legally inhabit.

RERA, once hailed as the savior, has become a toothless tiger in many jurisdictions. It can penalize the builder, but it cannot magically clear a title that was fraudulent from the 1980s. The “system” isn’t broken; it was designed this way to ensure that the developer and the politician get their cut, while the buyer gets the “Certificate of Dispute.”

Table 4: The 2026 Flat-Buyer’s Nightmare Scale

| Stage of Fraud | Tactic Used | Risk to Capital |

| Pre-Launch | Selling on Unapproved Land | 100% Loss |

| Construction | Diversion of Funds (Liquidity Crunch) | 3-5 Year Delay |

| Possession | No OC (Occupancy Certificate) | Permanent Legal Limbo |

| Post-Possession | Maintenance Fund Embezzlement | Recurring Annual Loss |

| Resale | Hidden Dues/Unpaid Land Tax | Legal Liability for Buyer |

Kadhwa Sach (The Bitter Truth): Buying a flat today is often just buying the right to sue a billionaire developer. It’s a lopsided war where you have the law, but they have the clock.

The “Silent” State Breakdown: Regional Crime Dynamics

Why is Bihar (18,000 cases) more dangerous than Kerala (8,000 cases), despite the latter having higher property values? It’s the Institutional Integrity Index. In states where the local “Strongman” (Bahubali) culture is integrated into the political fabric, property crime is an industry. It is a structured business with its own HR, legal wing, and enforcement department.

In West Bengal (16,000 cases), the issue is often Political Patronage Encroachment. If you don’t align with the local power center, your “right to property” evaporates. This isn’t just about money; it’s about control. By controlling who lives where, they control the vote. This is the dark underbelly of Indian real estate that no “Property Expo” will ever tell you about.

Meanwhile, the 10,000 cases in Gujarat tell a story of Industrial Land Grabs. As the state pushes for massive manufacturing hubs, small landowners are being coerced—legally and illegally—to part with their goldmines for peanuts.

The Unholy Trinity: Why the System is Designed to Fail You

If you still believe that a property dispute is just a “misunderstanding” between two private parties, you are dangerously naive. In 2026, property crime is not a random act of greed; it is a Structured Corporate Enterprise. To understand why 2.27 lakh cases are clogging the system, you must look at the Nexus—the invisible glue holding together the corrupt politician, the compromised police officer, and the predatory land shark.

This isn’t a conspiracy theory; it’s the business model of the Indian hinterland and the urban jungle alike. The “system” isn’t failing by accident—it is functioning exactly as intended for those who run it.

The “Thana-Tehsil” Syndicate: The First Barrier

The moment you realize your land has been encroached upon, your first instinct is to run to the police. Big mistake. In high-risk states like Uttar Pradesh (28,000 cases) and Bihar (18,000 cases), the local Thana (Police Station) and Tehsil (Revenue Office) often act as the sales and marketing wings of the Land Mafia.

The playbook is simple: The revenue clerk (Patwari/Lekhpal) identifies a “vulnerable” property—usually belonging to an NRI, a widow, or an elderly couple. He “leaks” the title details to a local strongman. When the victim goes to file an FIR, the police treat it as a “Civil Matter.” This is the deadliest phrase in the Indian legal lexicon. By labeling it civil, the police wash their hands of it, giving the criminal months, if not years, to build a boundary wall and create “adverse possession.”

Table 5: The Anatomy of a Land Grab (The Payoff Structure)

| Stakeholder | Role in the Crime | Typical “Cut” (Black Money) |

| The Informant (Lekhpal/Clerk) | Provides “clean” forged records | 5-10% of Market Value |

| The Muscle (Land Mafia) | Physical occupation and intimidation | 20-30% of Market Value |

| The Facilitator (Police) | Delaying FIRs and “Civil” labeling | Monthly “Protection” Retainer |

| The Political Patron | Shielding the Mafia from high-level inquiry | Bulk Election Funding |

| The Legal Fixer | Filing “frivolous” counter-suits to stall | Hourly / Per-Hearing Fees |

The Bitter Truth: In 2026, the law doesn’t protect the owner; it protects the person in physical possession. If you lose the ground, you lose the war.

White-Collar Sharks: The Sophisticated Urban Predator

In states like Tamil Nadu (12,000 cases) and Karnataka (11,000 cases), the game is more sophisticated. We are seeing the rise of the “Legal Land Shark.” These are individuals with law degrees who specialize in finding minute technical flaws in land titles from the 1960s or 70s.

They don’t send goons; they send Legal Notices. They file a suit claiming that their “grandfather” was the original tenant. This effectively “freezes” your property. You can’t sell it, you can’t develop it, and you can’t mortgage it. Then comes the “Settlement Offer.” They ask for 20% of the property value to “withdraw” the fake case. It is legalized extortion, and the 2026 data shows it is the fastest-growing segment of property crime in Tier-1 cities.

Table 6: Regional Tactics of the Nexus (2026 Trends)

| Region | Dominant Tactic | State Example |

| North India | Physical Encroachment & Muscle | UP, Haryana, Rajasthan |

| South India | Document Forgery & Technical Litigations | TN, Karnataka, Kerala |

| East India | Political Occupations & Syndicate Raj | West Bengal, Jharkhand |

| West India | Redevelopment Fraud & FSI Scams | Maharashtra, Gujarat |

Sunhara Avsar (The Golden Opportunity): The only way to win is to be more “visible” than the criminal. Fencing, CCTVs, and regular public notices of ownership are no longer optional—they are survival tools.

The “Human” Cost: Beyond the Numbers

Behind the 22,000 cases in Maharashtra are thousands of retired professionals who spent their life savings on a “dream home,” only to find themselves standing in a corridor of the Bombay High Court ten years later, clutching a plastic folder of yellowing papers.

The psychological trauma is immense. We see a rise in “Property-Induced Anxiety” among the middle class. The fear that a single signature at a Registrar’s office could delete thirty years of hard work. The criminal knows this fear. He uses it as a lever. He knows that you have a job, a family, and a heart condition. He has nothing but time and the “Nexus” behind him.

The 2.27 lakh cases are a testament to a nation where “Trust” has become a luxury item. We are moving toward a society where you don’t “own” land; you merely “rent” peace of mind from the local power structures.

The Global “Laundromat”: Real Estate as the Ultimate Currency of Crime

If you think property crime is just about a local goon grabbing a plot, you are missing the forest for the trees. In 2026, real estate has evolved into the world’s most preferred “Shadow Currency.” From the skyscrapers of London to the villas of Dubai and the farmhouses of Alibaug, property is no longer just an asset—it is the ultimate “washing machine” for illicit wealth.

While the common man struggles with 2.27 lakh reported crimes, the elite criminal is playing a different game: Integration. They don’t want to steal your land; they want to use the entire sector to make “dirty” money look “clean.”

The “Integration” Stage: Why Property is Perfect for Laundering

Real estate offers something that Bitcoin or gold cannot provide at scale: Value Manipulation. By overvaluing or undervaluing a property during a transaction, millions of dollars can be transferred across borders with a single signature.

In 2026, we see a massive surge in “Loan-Back” Schemes. A criminal sets up a shell company in a tax haven like the Cayman Islands. That company “lends” money to the criminal’s legitimate Indian firm to buy a commercial complex. He then “repays” the loan with illicit cash. To the tax authorities, it looks like a standard business debt. To the criminal, it’s a masterclass in financial alchemy.

Table 7: Global vs. Indian Property Fraud Tactics (2026)

| Tactic | Global Trend (UK, UAE, USA) | Indian Reality (UP, MH, KA) |

| Identity Theft | Deepfake/AI Personation for e-Registry | Forged Physical PoA & Impersonation |

| Vehicle | Anonymous Shell Companies & Trusts | Benami Transactions (Proxies/Staff) |

| Laundering Method | Rapid “Flipping” across jurisdictions | Cash-heavy “Under-the-Table” deals |

| Regulatory Focus | 6AMLD & FinCEN Reporting | RERA & PMLA Seizures |

| Impact | Artificially Inflated Urban Housing | Generational Legal Deadlock |

The Bitter Truth: Global real estate is estimated to harbor over $2 trillion in illicit funds. Your neighborhood’s “sky-high” property prices aren’t always a sign of growth; often, they are just the byproduct of a global laundering spree.

The Rise of the “Phantom Agent”: Online Property Fraud in 2026

The internet was supposed to democratize real estate. Instead, it has created a breeding ground for the Phantom Agent. In 2026, fake listings on popular property portals have become a multi-crore industry.

Scammers use high-resolution, stolen photos of luxury apartments in Mumbai or Bengaluru, list them at 30% below market price, and target desperate middle-class buyers. They create a sense of “False Scarcity,” demanding a “Token Amount” for a site visit. By the time 100 people pay ₹50,000 each, the agent—and the website listing—have vanished.

Table 8: Red Flags of the “Modern Phantom”

| Red Flag | Description | Risk Level |

| Price Deviation | Price is >20% lower than the neighborhood average | Extremely High |

| Communication | Insistence on WhatsApp/Telegram only; no office visit | High |

| Urgency | “Multiple buyers interested; pay now to lock the deal” | Critical |

| Paperwork | Scanned copies only; refusal to show original deeds | Fatal |

Kadhwa Sach (The Bitter Truth): If a deal looks like a “Steal,” you are likely the one being robbed. There are no “Secret Bargains” in the age of information.

The “NRI” Bullseye: Targeted Predation

As of early 2026, NRIs (Non-Resident Indians) remain the primary “prey” for organized syndicates. The data suggests that properties left vacant for more than 24 months have a 60% higher chance of being embroiled in a fraudulent “adverse possession” or “double-sale” claim.

The Mafia knows that an NRI cannot fly back for every court hearing. They rely on the “Attrition Strategy”—dragging a fake case for 15 years until the owner, tired of the legal bills and the transatlantic flights, settles for a fraction of the property’s value. This isn’t just crime; it’s a war of nerves.

My Verdict: The Death of Passive Ownership (2026-2030 Vision)

We are moving into an era where “buying and forgetting” is a recipe for financial suicide. The 2.27 lakh cases currently clogging the Indian judicial system are not a backlog—they are a warning. If the first half of this decade was about the digitalization of records, the second half (2026-2030) will be defined by the Validation Crisis.

The “Human Touch” in property management is being replaced by cold, hard data, but as I’ve demonstrated, data can be manipulated. My verdict is clear: In the next four years, your property’s value will be determined less by its location and more by the “purity” of its digital and physical title.

Strategic Predictions for 2026-2030

-

The Rise of “Title Insurance”: By 2028, no major bank will lend against a property without a private Title Insurance policy. The government’s guarantee will be seen as insufficient.

-

AI-Powered “Squatter” Detection: We will see the emergence of specialized prop-tech firms using satellite imagery and AI to alert owners of even a single brick being moved on their vacant land in real-time.

-

The “Linguistic” Shift in Fraud: As Tier-1 cities become saturated and hyper-monitored, the Land Mafia will migrate to Tier-2 and Tier-3 cities in Odisha (9,000 cases), Jharkhand (6,000 cases), and Chhattisgarh (5,500 cases), where legal awareness is lower and the “Nexus” is stronger.

-

Tokenization vs. Reality: While “Fractional Ownership” will be marketed to the youth, the underlying disputes will make these tokens worthless in 40% of cases.

Table 9: The Ownership Evolution (2020 vs 2030)

| Feature | The 2020 Mindset | The 2030 Necessity |

| Verification | One-time due diligence | Continuous Title Monitoring |

| Security | A watchman and a fence | Biometric Registry & Drone Surveillance |

| Documentation | Physical File / Digilocker | Blockchain-verified Smart Contract |

| Legal Strategy | Reactive (Sue when grabbed) | Proactive (Preventive Litigation) |

| Investment Goal | Capital Appreciation | Asset Sovereignty |

Sunhara Avsar (The Golden Opportunity): The “Distressed Asset” market will boom. Smart investors will buy disputed properties at 40% value, using high-end legal “clearing houses” to fix titles and resell at 100%. The profit is no longer in the land; it’s in the legal cleanup.

Final Strategy: How to Protect Your Legacy

Stop being a victim of your own optimism. The “system” will not protect you because the system is busy protecting itself. If you own property in India in 2026, follow these non-negotiable rules:

-

Audit Your Title Annually: Treat your land like a bank account. Check the revenue records (7/12, Adangal, Jamabandi) every six months. If a change appears without your signature, you have 48 hours to act before it becomes “standard record.”

-

Public Presence: For vacant plots, “Possession” is demonstrated by use. Lease it for organic farming, a nursery, or even a parking lot. A “Vacant” sign is a “Steal Me” sign.

-

Digital Hygiene: Ensure your Aadhaar is linked to your property records, but more importantly, ensure your mobile number at the Registrar’s office is active and monitored.

The Final Word

The 2026 crime data is a mirror reflecting our greed and our negligence. 2.27 lakh families are currently fighting for what is rightfully theirs. Don’t be the 2,27,001st. In the kingdom of land, the man with the most recent, most verified, and most physically defended record is the only true King.

Kadhwa Sach: Your children won’t inherit your land; they will inherit your lawsuits, unless you fix the title today.

Frequently Asked Questions (Property Crimes 2026)

1. Which states are the most dangerous for property owners right now? Based on the 2026 data, Uttar Pradesh (28,000 cases) and Maharashtra (22,000 cases) are the highest-risk zones. While UP suffers from physical encroachment and “strongman” tactics, Maharashtra leads in sophisticated urban redevelopment and double-selling frauds.

2. Is “Digital India” making land records 100% safe? No. While digitalization reduces manual bribery, it has birthed “Digital Record Tampering.” Fraudsters now target database vulnerabilities or use identity theft (deepfakes) to authorize transfers. A digital record is only a “snapshot”; it requires constant monitoring.

3. What is the deadliest phrase in a property dispute? The phrase “It’s a Civil Matter.” When police label a land grab as civil, they stop investigating, forcing you into a 20-year court battle. This allows the encroacher to maintain physical possession, which is “ten-tenths of the law” in the Indian hinterland.

4. Why are NRIs and senior citizens the primary targets? Because of the “Attrition Strategy.” Criminals know these groups cannot easily visit the site or attend frequent court hearings. The Mafia relies on exhausting the victim’s patience and finances until they agree to a “settlement” at a massive loss.

5. Does a “RERA Approved” project guarantee a clear title? Not necessarily. RERA ensures the builder follows the plan and timeline, but it doesn’t always guarantee that the land’s historical title (from 30–50 years ago) is free of hidden claimants. Always conduct an independent 30-year title search.

Data Source

- National Crime Records Analysis

- State Revenue Departments

- Investigative Legal Audits.