The American Mirage: Why the 2026 Poverty Data is a Blaring Siren for Global Markets

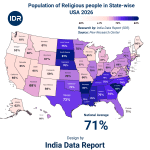

US Poverty Rate – State-wise (2026)

| S.N. | State | Poverty Rate (%) |

|---|---|---|

| 1 | South Dakota | 19.0% |

| 2 | Montana | 18.8% |

| 3 | Maine | 18.8% |

| 4 | Mississippi | 18.8% |

| 5 | Alaska | 18.0% |

| 6 | Louisiana | 18.7% |

| 7 | New Mexico | 17.8% |

| 8 | Alabama | 17.8% |

| 9 | Arkansas | 16.8% |

| 10 | West Virginia | 16.7% |

| 11 | Kentucky | 15.8% |

| 12 | North Carolina | 14.7% |

| 13 | Tennessee | 14.2% |

| 14 | South Carolina | 14.0% |

| 15 | California | 13.9% |

| 16 | Nevada | 13.8% |

| 17 | Texas | 13.4% |

| 18 | Georgia | 13.3% |

| 19 | Arizona | 13.2% |

| 20 | Florida | 13.1% |

| 21 | Indiana | 12.9% |

| 22 | Washington | 12.9% |

| 23 | Michigan | 12.8% |

| 24 | Missouri | 12.5% |

| 25 | Ohio | 12.4% |

| 26 | Pennsylvania | 11.2% |

| 27 | Hawaii | 10.5% |

| 28 | Minnesota | 10.6% |

| 29 | Wyoming | 10.4% |

| 30 | Colorado | 10.4% |

| 31 | North Dakota | 10.4% |

| 32 | Illinois | 10.2% |

| 33 | Iowa | 10.1% |

| 34 | Nebraska | 10.1% |

| 35 | Oregon | 10.0% |

| 36 | Kansas | 9.7% |

| 37 | Virginia | 9.8% |

| 38 | Wisconsin | 9.5% |

| 39 | Utah | 8.3% |

| 40 | New York | 13.9% |

| 41 | Idaho | 10.3% |

| 42 | Oklahoma | 13.7% |

| 43 | Vermont | 9.9% |

| 44 | New Hampshire | 7.2% |

| 45 | Massachusetts | 7.2% |

| 46 | Maryland | 8.6% |

| 47 | New Jersey | 9.0% |

| 48 | Rhode Island | 10.1% |

| 49 | Delaware | 8.6% |

| 50 | Connecticut | 8.3% |

US National Average Poverty Rate: ~12–13% (approx.)

The “Land of the Free” is currently shackled by a reality that Wall Street’s glossy brochures refuse to acknowledge. If you’ve been comfortably sipping the Kool-Aid of a “soft landing” and “resilient consumer spending,” the 2026 state-wise poverty data is about to give you a very cold, very necessary shower. We aren’t just looking at numbers on a spreadsheet; we are looking at the systematic erosion of the American dream, masked by high-frequency trading and geopolitical grandstanding.

While the “Averages” try to paint a picture of a stable 12.5% national poverty rate, the granular truth is far more violent. Look at the edges—South Dakota, Montana, Maine. These aren’t just states; they are the canaries in the coal mine, gasping for air with poverty rates nearing 20%. When one-fifth of your population in the “heartland” can’t afford the basics, your economic engine isn’t purring; it’s seizing up.

The Great Disconnect: Wealth at the Top, Rot at the Roots

Economists love to talk about “aggregate demand,” but they rarely talk about the human desperation required to sustain it. In 2026, we see a United States bifurcated not just by politics, but by a visceral survival gap. The coastal elites in Massachusetts and New Hampshire might look down from their 7.2% safety nets, but the rot in the Deep South and the rural North is spreading.

The most disturbing part? This isn’t a “red state” or “blue state” problem. This is a structural failure of capital distribution. Look at California—the world’s fifth-largest economy—sitting with a 13.9% poverty rate. How do you reconcile Silicon Valley’s trillion-dollar valuations with nearly 14% of the population wondering where their next meal is coming from? You don’t. You simply ignore it until the social fabric tears.

Table 1: The High-Voltage Warning States (Top 10 Poverty Peaks)

| State | Poverty Rate (2026) | Economic Context |

| South Dakota | 19.0% | Agricultural stagnation & lack of industrial pivot. |

| Montana | 18.8% | Housing crisis fueled by “Zoom-town” gentrification. |

| Maine | 18.8% | Aging workforce & energy cost volatility. |

| Mississippi | 18.8% | Intergenerational systemic neglect. |

| Alaska | 18.0% | Extreme logistical inflation & resource dependence. |

| Louisiana | 18.7% | Climate catastrophe insurance premiums crushing households. |

| New Mexico | 17.8% | Federal funding reliance vs. private sector vacuum. |

| Alabama | 17.8% | Wage stagnation despite manufacturing “onshoring.” |

| Arkansas | 16.8% | Retail sector automation displacing low-skill labor. |

| West Virginia | 16.7% | The painful, unmanaged death of the coal identity. |

Kadhwa Sach (The Bitter Truth): Being “employed” in 2026 no longer means you are out of poverty. The “Working Poor” demographic has expanded because inflation has outpaced the meager 3% annual raises that corporations boast about in their ESG reports.

The Illusion of the National Average

The National Average of ~12-13% is a psychological sedative. It’s designed to keep the international markets from panicking. But when you dissect it, you see the “Hollow Middle” effect. We are seeing a massive flight of the middle class into the “near-poverty” bracket—those living at 150% of the poverty line who are one medical bill away from total ruin.

Let’s talk about the “Shadow Poverty.” In states like New York (13.9%), the cost of living adjustment (COLA) means that 13.9% is likely a gross understatement of actual hardship. If you earn $40,000 in NYC, you aren’t “above poverty”; you are effectively destitute. The 2026 data fails to capture the “hidden” struggle of the urban underclass because our metrics for defining poverty are stuck in the 1960s.

Table 2: The “Safe Havens” – A False Sense of Security?

| State | Poverty Rate (2026) | The Underlying Risk |

| New Hampshire | 7.2% | Proximity to Boston’s wealth; extreme tax sensitivity. |

| Massachusetts | 7.2% | Tech/Bio-tech bubble dependency. |

| Maryland | 8.6% | Federal government payroll insulation. |

| New Jersey | 9.0% | Commuter wealth vs. inner-city decay. |

| Utah | 8.3% | Strong social safety nets (community-driven) facing strain. |

Sunhara Avsar (The Golden Opportunity): For the global investor, the “poverty belt” identifies where the next wave of populist-driven policy shifts will occur. Smart capital is already hedging against the inevitable tax hikes required to fix this crumbling foundation.

Is the American consumer still the world’s buyer of last resort? Only if they can borrow. With credit card interest rates at historic highs and the poverty rates in states like South Dakota hitting 19%, the “debt-fueled consumption” model is hitting a brick wall. We are witnessing the slow-motion collapse of the bottom 40% of the American economy, and the 2026 data is the first chapter of a very dark book.

The Psychology of Despair – Why “The American Dream” is Being Short-Sold

If you think these percentages are just cold data, you’ve never looked into the eyes of a father in West Virginia (16.7% poverty) who has done everything “right” and still can’t afford his daughter’s insulin. We are no longer dealing with a temporary cyclical downturn; we are witnessing a fundamental psychological fracture. The American worker is currently trapped in a “Survival Loop,” and the global economic implications are terrifying.

When poverty hits nearly 19% in states like Montana and South Dakota, it changes the way people think. It shifts the brain from “innovation and investment” to “hoarding and hostility.” This is where the “Fear-Greed” index breaks. Usually, when the market dips, greed kicks in and people buy the “fucking dip.” But in 2026, the American consumer is too exhausted to be greedy. They are just trying to stay liquid.

The Death of Social Mobility

The most dangerous lie being sold today is that these poverty-stricken states are just “lagging behind.” They aren’t lagging; they are being stripped for parts. The migration of capital to the 7.2% states (Massachusetts, New Hampshire) has created a Wealth Apartheid.

If you are born in the bottom quintile in Mississippi (18.8%), your chances of reaching the top decile are statistically negligible. This isn’t just a social tragedy; it’s an economic waste of human capital. We are essentially burning the fuel of our future economy to keep the current quarter’s earnings looking “green.”

Table 3: The Consumption Cracks (How Poverty Stifles the Market)

| State Category | Avg. Poverty | Primary Spending Behavior (2026) | Market Impact |

| The Rust/Coal Belt | 16%+ | Debt servicing and basic caloric intake. | Zero discretionary growth. |

| The Sun Belt | 13-14% | High-interest “buy now, pay later” (BNPL) reliance. | Vulnerable to credit defaults. |

| The Tech Corridors | < 9% | Premium services and asset inflation. | Driving a “Two-Tier” retail reality. |

Kadhwa Sach (The Bitter Truth): The “Resilient Consumer” is a myth built on a mountain of subprime credit. In 2026, the “Average American” is essentially a walking debt-instrument, being squeezed for interest until they drop into the poverty statistics we are discussing.

The “Middle-Class” Mirage: 13% is the New 0%

In states like Texas (13.4%) and Florida (13.1%), the narrative has always been about “growth” and “no income tax.” But the data reveals the cost of that growth. Rapid urbanization has driven housing costs so high that even “decent” wages are now poverty-level wages in real terms.

When we look at the 13.9% poverty rate in New York and California, we are seeing the Collapse of the Urban Middle. These states are becoming “Barbell Economies”—extreme wealth at one end, extreme poverty at the other, and a rapidly disappearing center. This is the exact recipe for the kind of civil unrest that makes international investors pull their hair out.

Table 4: The Real Cost of “Growth” in High-Poverty States

| State | Poverty Rate | 2026 Housing Inflation vs 2021 | The “Silent” Squeeze |

| Florida | 13.1% | +42% | Insurance premiums are the new “Poverty Tax.” |

| Texas | 13.4% | +38% | Property taxes hitting the “Asset-Poor” hard. |

| Arizona | 13.2% | +35% | Water scarcity driving up basic utility costs. |

Sunhara Avsar (The Golden Opportunity): The “Distressed Debt” market in these high-poverty states is the only place left for aggressive yields. If you aren’t looking at the foreclosure rates in Arkansas and Tennessee, you aren’t looking at the real America.

The Truth Behind the Curtain

Is the US still the “shining city on a hill”? Or has it become a gated community surrounded by a wasteland? The 2026 data suggests the latter. When the “National Average” is 12.5%, but the “Human Average”—the lived experience of the majority—feels like 20%, you have a legitimacy crisis.

The American consumer isn’t just “slowing down”; they are checking out. They are tired of being the engine for a car they can’t afford to ride in. This is the psychological reality that will dictate the 2028 elections and, more importantly, the next decade of global trade.

Corporate Cannibalism – Profiting from the Bottom of the Pyramid

Let’s stop being polite. In the boardrooms of the S&P 500, poverty isn’t viewed as a “social ill”—it’s a market segment. While the talking heads on financial news networks bemoan the “struggling consumer,” the smartest vultures in the room are pivoting. We are entering the era of Corporate Cannibalism, where the economic decay of states like South Dakota and Louisiana is being monetized with surgical precision.

When you see a 19.0% poverty rate in South Dakota, don’t think “loss of revenue.” Think “Dollar Store expansion.” Think “Payday Loan securitization.” In 2026, the American economy has split into two distinct machines: one that sells dreams to the 7% in Massachusetts, and another that harvests the remaining nickels from the 18.8% in Mississippi.

The “Poverty Trap” Business Model

In states with poverty rates exceeding 15%, we are seeing the death of the independent small business. They can’t survive the thinning margins. Into this vacuum step the “Value Giants.” These corporations don’t just provide cheaper goods; they create a closed-loop ecosystem of dependency.

Look at Arkansas (16.8%) and Alabama (17.8%). These aren’t just states; they are testing grounds for automation. When labor is desperate, they accept lower wages. When they can’t even afford those low wages, the companies replace them with kiosks. It’s a race to the bottom where the “winner” is the entity with the lowest overhead and the highest interest rate on their proprietary credit cards.

Table 5: The “Vulture” Index – Sectors Flourishing in High-Poverty States

| Industry Sector | Growth in High-Poverty States (2026) | The “Revenue” Source | Ethical Outlook |

| Deep-Discount Retail | +14.2% | Shrinkflation & high-margin generic goods. | Parasitic but “essential.” |

| Subprime Fintech | +22.5% | BNPL (Buy Now, Pay Later) fees & interest. | Predatory financial engineering. |

| Fast-Food Automation | +18.0% | Eliminating the “Working Poor” payroll. | Efficiently heartless. |

| Used Auto Financing | +9.7% | 25%+ APR loans for essential transport. | Modern-day debt peonage. |

Kadhwa Sach (The Bitter Truth): Many of the companies in your retirement portfolio are currently thriving because these poverty rates are high. They have optimized the art of selling “poverty-grade” products at “luxury-grade” margins by exploiting the lack of choice in rural America.

The “Onshoring” Lie: Why Factories Aren’t Saving the South

Politicians love to cut ribbons at new EV battery plants in Tennessee (14.2%) or North Carolina (14.7%) and claim the “Middle Class is back.” It’s a PR stunt. The 2026 data shows that while the factories are coming back, the wealth isn’t.

These new jobs are highly automated and require specialized skills that the local, underfunded education systems in high-poverty states simply don’t provide. The result? Companies “import” talent from the 8% poverty states (like Maryland or Virginia), while the locals are left with the low-tier service jobs cleaning the factory floors. The poverty rate stays stagnant, while the GDP of the state appears to rise. It’s a statistical sleight of hand.

Table 6: The “New Industrial” Paradox (Growth vs. Reality)

| State | Poverty Rate | New Industrial Investment (2025-26) | Why Poverty Isn’t Budging |

| Kentucky | 15.8% | High (Electric Grid/Battery) | “Leaky Bucket” economy; profits exit the state. |

| South Carolina | 14.0% | Moderate (Manufacturing) | Wage suppression via “Right to Work” laws. |

| Ohio | 12.4% | High (Semiconductors) | The “Two-Speed” workforce (Tech vs. Traditional). |

Sunhara Avsar (The Golden Opportunity): The real “smart money” isn’t investing in the factories; it’s investing in the private infrastructure surrounding them—healthcare clinics and low-income housing—where the demand is inelastic and the government subsidies are guaranteed.

The Truth of the 2026 “Recovery”

What we are calling “growth” in 2026 is actually just consolidation. The wealth is being sucked out of the 18% states and concentrated into the digital accounts of the 1%. Every time a family in West Virginia switches from a local grocer to a multi-national discount chain, a piece of that state’s economic soul is exported to a tax haven.

We aren’t fixing poverty; we are refining it. We are making it “manageable” for the markets so that the stock index stays high while the standard of living drops. This is the truth that the 2026 poverty report screams at anyone brave enough to listen.

The Geopolitical Ticking Clock – America’s Soft Underbelly

While Washington is busy chest-thumping about “containing” foreign adversaries, those very adversaries are reading the 2026 poverty data like a tactical map. National security isn’t just about how many hypersonic missiles you have; it’s about whether your population in the “Heartland” feels like they have a stake in the system.

When 18.8% of people in Montana or 18.0% in Alaska are struggling to breathe financially, they become susceptible to economic subversion. We are seeing foreign “Soft Power” move into the vacuum left by federal neglect. Whether it’s foreign-backed land acquisitions or the quiet infiltration of alternative digital currencies in distressed regions, the U.S. is losing its grip on its own domestic loyalty.

The New “Third World” Within the First World

In 2026, the data reveals a terrifying trend: the “Internal Colonization” of America. States with double-digit poverty rates are becoming increasingly reliant on federal transfers that are losing their purchasing power. This creates a “Debt-Trap” not unlike the ones we see in developing nations.

If you are a global strategist, you see that the U.S. is no longer a monolith. It is a fragmented collection of “City-States” (the 7% poverty zones) surrounded by “Resource Colonies” (the 15%+ poverty zones). This fragmentation is the ultimate gift to any rival power looking to destabilize the dollar’s hegemony. A country that cannot feed its own “Great Plains” cannot hope to lead the “Great Oceans.”

Table 7: The Vulnerability Index (National Security vs. State Poverty)

| State | Poverty Rate | Strategic Asset | The Risk Factor |

| Alaska | 18.0% | Arctic Trade Routes / Oil | High susceptibility to foreign energy “partnerships.” |

| Montana | 18.8% | Nuclear Silos / Agriculture | Radicalization of the rural workforce. |

| New Mexico | 17.8% | Defense Research / Tech | Brain drain and security clearance vulnerabilities. |

| Louisiana | 18.7% | Critical Port Infrastructure | Infrastructure decay leading to supply chain fragility. |

Kadhwa Sach (The Bitter Truth): A hungry man doesn’t care about “Global Liberal Order” or “Democracy.” He cares about who can provide him with cheap energy and a stable job. By letting poverty fester at 18% in strategic states, the U.S. is effectively leaving its back door wide open.

The “Education Gap” as a Weapon of Mass Destruction

Let’s look at the correlation between the 2026 poverty rates and the collapse of the local labor pool. In states like West Virginia (16.7%) and Kentucky (15.8%), the education system has been decimated by “budget optimizations.”

What is the result? A workforce that is functionally obsolete in the age of AI and advanced robotics. While the “Coastal Elites” talk about the “Future of Work,” the “Heartland Poor” are being relegated to a permanent underclass. This isn’t just an economic tragedy; it’s a demographic time bomb. When you have a massive, young, and economically desperate population with no path upward, history tells us exactly what happens next: Populism, followed by Totalitarianism.

Table 8: The “Brain Drain” Export – How Wealthy States Harvest Talent

| Source State (High Poverty) | Target State (Low Poverty) | The “Export” | Long-term Result |

| Mississippi (18.8%) | Texas (13.4%) | Skilled Youth | Mississippi becomes a “Retirement Desert.” |

| Maine (18.8%) | Massachusetts (7.2%) | Degree Holders | Maine loses its tax base, fueling more poverty. |

| Oklahoma (13.7%) | Colorado (10.4%) | Tech Labor | Centralized “Wealth Hubs” vs. Rural “Dead Zones.” |

Sunhara Avsar (The Golden Opportunity): For those looking at the 2030 horizon, the real opportunity lies in “Second-Tier City Arbitrage.” As people flee the 19% poverty states, they are flooding into mid-tier hubs in “poverty-adjacent” states that still offer a semblance of the American Dream.

The Truth of our Sovereignty

Sovereignty isn’t a flag; it’s a paycheck. In 2026, for nearly 40 million Americans, that paycheck is either non-existent or insufficient. We are currently witnessing the “hollowing out” of the American interior. If the current trajectory holds, by 2030, the United States will look less like a superpower and more like a collection of prosperous coastal enclaves desperately trying to manage a restless, impoverished hinterland.

The 2026 poverty data isn’t a “glitch” in the system. It is the output of the system. The question isn’t whether we can fix it—the question is whether those in the 7% zones even want to.

My Verdict – The 2030 Reckoning and the Survival Blueprint

We’ve dissected the data, exposed the corporate vultures, and mapped the geopolitical cracks. Now, let’s stop the analysis and look at the execution. As an Economic Strategist, I don’t deal in “hope”—I deal in trajectories. And the trajectory of the 2026 poverty data leads to a singular, violent conclusion: The Great Reset of the American Standard of Living.

The “National Average” is a ghost. By 2030, the United States will no longer function as a single economy. It will be a “Tri-Tiered Society.” If you aren’t positioning yourself now, you will be liquidated by the very statistics we’ve discussed.

My Verdict: The End of the “Consumer” Era

The American economy, since 1945, has been built on the “Average Joe” buying things he doesn’t need with money he doesn’t have. The 2026 data shows that “Average Joe” is now officially broke. In states like South Dakota and Montana, the consumer has transitioned from “discretionary spender” to “subsistence survivor.”

This isn’t a recession; it’s a structural downsizing. The “American Dream” is being replaced by “American Resilience”—a polite way of saying “get used to having less.”

Table 9: 2026-2030 Bold Predictions (The Macro Shift)

| Metric | 2026 Status | 2030 Prediction | The Human Impact |

| National Poverty | ~12.5% | 15.2% | The “Middle Class” becomes the “Working Poor.” |

| Federal Debt | Historic Highs | Monetized / Soft Default | Massive devaluation of the USD; savings evaporated. |

| The “Zip-Code” Gap | 12% Variance | 25% Variance | Gated states vs. “No-Go” economic zones. |

| Retail Landscape | Hybrid | 90% Automated/Discount | The death of the “Shopping Experience.” |

Kadhwa Sach (The Bitter Truth): The government will not save you because the government is the 7% poverty bracket. Their reality in Maryland and DC is fundamentally detached from the 18.8% reality in Mississippi. They are managing a decline, not engineering a recovery.

The 2030 Vision: Where is the Money Going?

If you want to survive the next four years, you must follow the Migration of Necessity. As the “Heartland” poverty rates climb, we will see a massive internal refugee crisis. People will flee the 19% states, not for jobs, but for survival infrastructure—better healthcare, more stable power grids, and basic safety.

Table 10: The Survival Playbook (2026-2030)

| Action | Strategy | Target States | Why? |

| Asset Pivot | Exit “General Retail” | Massachusetts, Washington | Bet on the “Immune” enclaves. |

| Labor Shift | AI-Complementary Skills | Utah, Virginia | Avoid the “Automation Trap” of the South. |

| Real Estate | High-Yield “Distressed” | Ohio, Pennsylvania | Buy where others are fleeing, but only near “Safe Hubs.” |

| Currency | Diversification | N/A | Hedge against the USD’s “Poverty Dilution.” |

Sunhara Avsar (The Golden Opportunity): The biggest wealth transfer in history is happening now. It is moving from the uneducated, debt-ridden masses into the hands of those who own the “Platforms of Survival”—healthcare, automated logistics, and private security.

Final Thoughts: The Truth is a Choice

The 2026 state-wise poverty report is a mirror. It shows a country that has traded its future for quarterly dividends. It shows a society where “success” is defined by how far away you can live from the 19% poverty zones.

You can choose to believe the “Soft Landing” narrative and wait for the “National Average” to improve. Or, you can accept the reality: The floor is falling out. The states with 18%+ poverty are not “outliers”—they are the future for anyone who remains complacent.

Top 5 FAQs

1. Why is poverty spiking in “Resource-Rich” states like Montana and Alaska?

It’s the “Cost of Living Paradox.” While these states produce energy and food, the local populations are being crushed by “Zoom-town” gentrification and logistical inflation. When outsiders move in with coastal salaries, they drive up housing and heating costs, pushing the locals—who are on stagnant wages—directly into the 18%+ poverty bracket.

2. Is the 12.5% National Average a reliable metric?

Absolutely not. It’s a statistical sedative. By averaging the 7.2% poverty of Massachusetts with the 19.0% of South Dakota, the government masks the reality of a “Broken America.” If you live in a high-cost urban center, the federal poverty line is a joke; you can be earning double the poverty threshold and still be functionally homeless.

3. How does this data affect the value of the US Dollar by 2030?

High poverty in the Heartland forces the Federal Reserve into a corner. To prevent social unrest, the government must increase “Social Transfers” (subsidies/welfare). This requires printing more money or taking on more debt, which eventually dilutes the purchasing power of your savings. Poverty is the ultimate “hidden” inflation driver.

4. Which sectors are the safest “Poverty Hedges” for investors?

Look for Inelastic Demand. No matter how poor a state like Mississippi gets, people still need:

-

Subprime Credit: High-interest “Rescue” loans.

-

Deep-Discount Retail: Dollar stores are the new department stores.

-

Maintenance Medicine: Low-cost clinics dealing with the health fallout of poverty.

5. Can the “Onshoring” of factories fix the 16-18% poverty rates?

Unlikely. Modern factories are “Job-Light.” A new $5 billion plant in the South might only employ 500 high-tech engineers (often brought in from out of state) while the 15,000 local applicants lack the technical training. This creates “Pockets of Prosperity” surrounded by “Deserts of Despair.”